Global pension risk transfer market – 2024 in review

Review of developments in the pension risk transfer markets in the UK, US, Canada and Germany during 2024 and key considerations for multinationals.

The global pension risk transfer (PRT) market remained strong in 2024, continuing the steady growth seen over the past few years. In comparison to 2023, there was a significant increase in the transaction volume in Canada and the USA of 41% and 14%, respectively. In the UK, there was a 30% increase in the number of transactions which has been attributed to the increased willingness of insurers to accept smaller sized defined benefit (DB) pension plans and insurers streamlining their transaction processes.

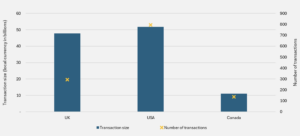

Global pension risk transfer market activity in 2024

Our experts in the UK, US, Canada and Germany review the developments in their PRT markets in 2024 and highlight some key considerations for multinationals looking to transact in 2025 and beyond.

United Kingdom

Author: Rosie Fantom

2024 in review:

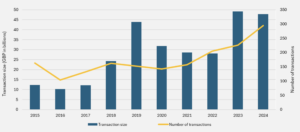

- In 2024, the UK bulk annuity market experienced unprecedented activity with a record 294 transactions worth GBP 47.8 billion, just short of 2023’s record breaking GBP 49.1 billion.

- For the first time, 6 insurers wrote over GBP 5 billion each and there were 14 buy-in transactions worth more than GBP 1 billion, with the majority of these taking place in the second half of 2024.

- The increase in activity was driven by the willingness of certain insurers to accept very small DB pension plans and insurers streamlining their transaction processes.

- The market benefited from the entry of 2 new insurers in 2024 (Royal London and Utmost) and another entrant (Blumont) earlier this year, taking the market to a record number of 11 insurers.

Pension risk transfer activity – UK

Key issues for multinationals:

- Decisions around transactions often need to be made quickly as pricing fluctuates. Multinationals should implement robust governance procedures, especially if decisions are being made outside of the UK, to avoid delays during the final stages of their risk transfer journeys.

- Data cleansing, GMP equalisation projects and resolving any benefit and legal uncertainties can be complex processes. It remains crucial for pension plans and sponsors to carefully plan, not only their entry into a transaction, but the next steps to ensure that the investment delivers the intended risk transfer.

- The expansion of the superfunds (a non-insurance risk transfer) market provides DB pension plans with a greater choice. 2024 marked the first superfund transfer of a DB pension plan with a non-distressed sponsor. Superfunds are a viable option for multinationals that are looking to reduce sponsor risk and secure member benefits for a DB pension plan that is less well funded.

United States

Author: Jake Pringle

2024 in review:

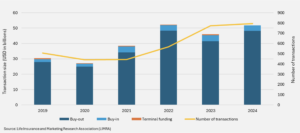

- In 2024, PRT in the USA surged to USD 51.8 billion, a 14% increase from the previous year. This growth was particularly notable in the first and third quarters, where sales were exceptionally strong.

- 14 carriers each closed a deal exceeding USD 1 billion which is a record-breaking total. Additionally, the number of single premium contracts sold reached an all-time high of 794.

- Despite fluctuations in quarterly performance, the overall trend indicates a robust and expanding interest in the PRT market, driven by plan sponsors’ ongoing efforts to de-risk their pension liabilities.

- Currently, there are 22 insurers operating in the US PRT market, all with varying specialties such as annuities in payment only or preferences in the size of the transaction.

Pension risk transfer activity – USA

Key issues for multinationals:

- US plan sponsors must conduct an objective, thorough and analytical search when selecting an annuity provider and consider the 6 criteria set out by the US Department of Labor’s Interpretive Bulletin 95-1 (‘DOL 95-1’). This ensures they are selecting an insurer that can supply the safest annuity available and ensures they are acting in the best interest of plan participants.

- A typical project takes between 2 to 3 months to complete depending on size and complexities. Like other PRT markets, the key to a successful and quick transaction is complete and accurate data, insurer capacity and good project co-ordination between plan sponsor, legal counsel, administration and actuarial advisers and the trustees.

Canada

Author: Philippe Rickli

2024 in review:

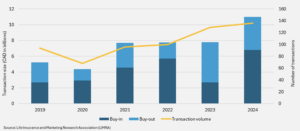

- In 2024, the Canadian group annuity market achieved an unprecedented level of transactions, totalling CAD 11 billion, marking a 42% increase compared to the average of the previous 3 years.

- The financial positions of DB pension plans improved significantly in 2024. This led to many organisations purchasing annuities to crystallise gains and enhance their plans’ financial stability.

- Despite increased volatility and narrowed credit spreads, insurers continued to offer competitive pricing for Canadian pension plans, making annuity purchases an appealing option for risk management.

- With the market’s enthusiasm, smaller plans sometimes faced difficulties finding an insurer to partner with, particularly in the latter half of the year. However, the number of transactions where DB pension plans committed to transacting with only one insurer rather than approaching the whole market increased, providing a viable strategy for smaller transactions.

- Insurers maintained competitive pricing for indexed annuities despite the Government of Canada ceasing the issuance of real return bonds in 2022. The largest indexed annuity transaction in the Canadian market occurred in 2024, exceeding CAD 1 billion.

Pension risk transfer activity – Canada

Key issues for multinationals:

- The publication of a new mortality improvement scale by the CIA in April 2024, which reflects greater life expectancy improvements, could impact the pricing of group annuities, even if insurers use their own mortality assumptions.

- The Canadian Association of Pension Supervisory Authorities (CAPSA) published Guideline No. 10 in September 2024, emphasising robust risk management frameworks for pension plan administrators. This guideline supports the use of annuity purchases as a proactive risk management strategy.

- The volatility of interest rates during annuity purchase transactions highlights the need for premium adjustment mechanisms. These mechanisms can reduce pricing volatility and improve insurer competitiveness, particularly for assets invested in fixed-income securities.

Germany

Author: Thomas Huth

2024 in review:

- Whilst the 2024 PRT market data is not expected to be released until July 2025, we anticipate the insurance-based pension buy-in market will continue its annual growth of around 1.0% – 1.5% that we have seen over the last few years.

- On the pension buy-out side, we have seen several smaller transactions during 2024, with the largest being around EUR 40 million.

- The key drivers of the PRT market in 2024 were mergers and acquisitions, liquidations, and rising interest rates.

- The market continues to garner significant interest with an increase in the number of companies exploring the feasibility of buying out some or all of their pension liabilities.

Key issues for multinationals:

- The German PRT market is largely unregulated and there are high levels of flexibility regarding the structuring of transactions (e.g. financing and selection of liabilities to be secured).

- One area multinationals should note when considering a buy-out are the provisions set out in section 16 of the German Occupational Pensions Act (Betriebsrentengesetz – BetrAVG). These require the employer to increase pensions in payment every 3 years, generally in line with CPI inflation, and subject certain other criteria, some of which allow room for interpretation where case law is not clearly established. This is an area the pension company taking on the liabilities will investigate to confirm compliance. If the pension increases granted do not meet the minimum legislative requirements, there is therefore the possibility of additional funding being needed before the transaction completes. Rectifying any past underpayments would also be administratively complex. It is therefore an area worth addressing as part of any feasibility study when considering a buy-out in Germany.

For more information on the latest developments, to review your global pension risk transfer strategy or for advice on de-risking your pension plans, please contact Isabel Coles or your local MBWL consultant.

Contacts

Elliot Colman

Global Benefits Consultant

VIEW PROFILE

Email:

elliot.colman@mbwl-int.com

Tel: +44 (0) 20 3949 5711

Elliot Colman

Global Benefits Consultant

Elliot is a Global Benefits Consultant for MBWL and is based in London. He joins MBWL from PwC where he started his career over 7 years’ ago. He has experience working as both a corporate pensions actuary before moving into a M&A team specialising in global defined benefit plans.

He brings expertise in advising both large multinational companies and private equity firms on global defined benefit plans, equity plans, and other employee related issues over the course of a deals cycle, including buy-side and vendor due diligence and bespoke strategic advice for sale.

Elliot graduated from the University of Nottingham with a first-class degree in BSc (Hons) Financial Mathematics and is a Fellow of the Institute of Actuaries in the UK.

Isabel Coles

Head of International Consulting, MBWL International

VIEW PROFILE

Email:

isabel.coles@mbwl-int.com

Tel: +44 20 3949 5710

Isabel Coles

Head of International Consulting, MBWL International

A multilingual expert in employee benefits for multinational corporates.

Isabel heads up MBWL International, advising multinational organisations on their employee benefits arrangements around the world, with a focus on corporate sales and purchases, accounting disclosures and the financing, risk management and design of benefit plans.

Her vast experience includes leading global accounting consolidations under international, UK and US accounting standards for multinational companies headquartered in the UK and overseas – with consolidations ranging in size from two to over 50 defined benefit plans.

She has advised both corporate and private equity buyers on the employee benefit considerations (including pension liabilities) associated with corporate sales and purchases in Europe and worldwide, from due diligence through to closing and subsequent integration work. Isabel has also undertaken many benefit audits and benchmarking exercises, including a 25-country audit for a company in the technology sector.

Other areas of Isabel’s expertise include reviewing and establishing international pension plans, advice on individual expatriate employee benefit packages and supporting multinationals in agreeing and implementing global governance approaches and policies for managing their employer benefit plans.

Isabel chairs the International Committee of the Association of Consulting Actuaries and is fluent in German and French.

Contacts

Elliot Colman

Global Benefits Consultant

VIEW PROFILE

Email:

elliot.colman@mbwl-int.com

Tel: +44 (0) 20 3949 5711

Elliot Colman

Global Benefits Consultant

Elliot is a Global Benefits Consultant for MBWL and is based in London. He joins MBWL from PwC where he started his career over 7 years’ ago. He has experience working as both a corporate pensions actuary before moving into a M&A team specialising in global defined benefit plans.

He brings expertise in advising both large multinational companies and private equity firms on global defined benefit plans, equity plans, and other employee related issues over the course of a deals cycle, including buy-side and vendor due diligence and bespoke strategic advice for sale.

Elliot graduated from the University of Nottingham with a first-class degree in BSc (Hons) Financial Mathematics and is a Fellow of the Institute of Actuaries in the UK.

Isabel Coles

Head of International Consulting, MBWL International

VIEW PROFILE

Email:

isabel.coles@mbwl-int.com

Tel: +44 20 3949 5710

Isabel Coles

Head of International Consulting, MBWL International

A multilingual expert in employee benefits for multinational corporates.

Isabel heads up MBWL International, advising multinational organisations on their employee benefits arrangements around the world, with a focus on corporate sales and purchases, accounting disclosures and the financing, risk management and design of benefit plans.

Her vast experience includes leading global accounting consolidations under international, UK and US accounting standards for multinational companies headquartered in the UK and overseas – with consolidations ranging in size from two to over 50 defined benefit plans.

She has advised both corporate and private equity buyers on the employee benefit considerations (including pension liabilities) associated with corporate sales and purchases in Europe and worldwide, from due diligence through to closing and subsequent integration work. Isabel has also undertaken many benefit audits and benchmarking exercises, including a 25-country audit for a company in the technology sector.

Other areas of Isabel’s expertise include reviewing and establishing international pension plans, advice on individual expatriate employee benefit packages and supporting multinationals in agreeing and implementing global governance approaches and policies for managing their employer benefit plans.

Isabel chairs the International Committee of the Association of Consulting Actuaries and is fluent in German and French.