Setting a global pension risk transfer strategy

Key considerations for corporates and overview of the pension risk transfer markets in the UK, US, Canada and Germany.

After years of funding deficits and cash calls on sponsoring employers, the higher interest rate environment in the last couple of years has led to improvements in funding defined benefit (DB) pension plan funding ratios, and surpluses are no longer a rarity. One consequence of this has been an explosion of activity in pension risk transfer markets globally, as companies take advantage of the opportunity to reduce and remove DB pension risk.

While pension risk transfer (PRT) transactions are often opportunistic in nature based on jurisdiction-specific factors, there is a real opportunity for multinational companies to develop a coherent pension risk transfer strategy to address their global DB pension risk exposure.

The most common type of PRT transaction is a “buy-out”, With a buy-out, plan assets are used to purchase a group annuity contract with an insurance company for some (“partial buy-out”) or all plan participants (“full buy-out”), removing them from the plan and transferring the pension liabilities associated risks to the insurer. A variation is the “buy-in” where plan assets are used to purchase a contract where the insurer reimburses the pension plan for payments to the covered participants. In this case the insurance contract is an asset of the plan, the plan continues to administer the participants’ benefits, but the risks associated with the covered benefits are now insured.

If the reduction and removal of DB pension risk is the objective of the corporate, establishing a robust global pension risk transfer strategy and communicating this effectively to the financial markets can provide shareholders and other stakeholders with reassurance that this (often significant) risk is being appropriately managed, strengthen the case for change, and greatly improve the chances of successful, timely execution. Whether this results in a consistent global strategy or a more nuanced picture varying locally, there are clear advantages in having a coherent global plan.

As part of setting their global strategy we help clients:

- Identify the DB plans where risks can be transferred and options available

- The steps needed to achieve successful PRT transaction – including factors that will impact the timeline

- Set priorities where there are multiple DB plans

- Consider alternative de-risking actions where a PRT transaction is not practical

- Track developments in PRT markets, including new solutions becoming available

Assessing pension risk transfer feasibility

Risk transfer markets vary in scale and coverage depending on the jurisdiction. Nevertheless there are some key commonalities to consider when assessing the feasibility of DB pension risk transfer transactions worldwide.

- Understand the key features of the pension risk transfer market in the country of operation. For example:

- Is pension risk transfer possible? If so, which risks can and cannot be transferred?

- Who are the key organisations accepting pension risk transfer transactions? Do these organisations have a particular target market or capacity constraints?

- What is the typical pricing for pension risk transfer transactions?

- Understand the position of the company’s DB pension plan(s). For example:

- Would the plan’s funding position support a transaction? If not, is the shortfall affordable or achievable in a reasonable timeframe? If the plan is in surplus, who owns this surplus?

- Are there any features of the pension plan that would prohibit a transaction or make it more challenging? Is plan documentation and participant data complete and accurate? Are there any concerns in terms of data privacy?

- Is pension risk transfer the right strategy for the DB pension plan based on the regulatory framework and other risk reduction options?

- Understand the steps required to achieve a transaction. For example:

- What is the typical process for securing a transaction? Are there any liquidity constraints or data quality issues that need to be addressed?

- What are the costs and expected timescales to execution?

- Who are the key stakeholders and what governance framework is required?

Answering these questions helps identify which of your pension plans are good candidates for a PRT transaction and the actions needed to prepare them.

Global risk transfer markets

A key part of determining whether pension risk transfer is right for your plan(s) is understanding the market in the relevant country, including the latest trends and developments. Some markets, like the UK and the US, have been writing PRT business for some time and see very large volumes of business, others are smaller in size or are at an earlier stage of development. Our risk transfer experts in the UK, the US, Canada and Germany share a snapshot of each of these markets with their insights below.

|

United Kingdom |

Rosie Fantom |

||

|

|

|

||

|

Snapshot

|

|||

|

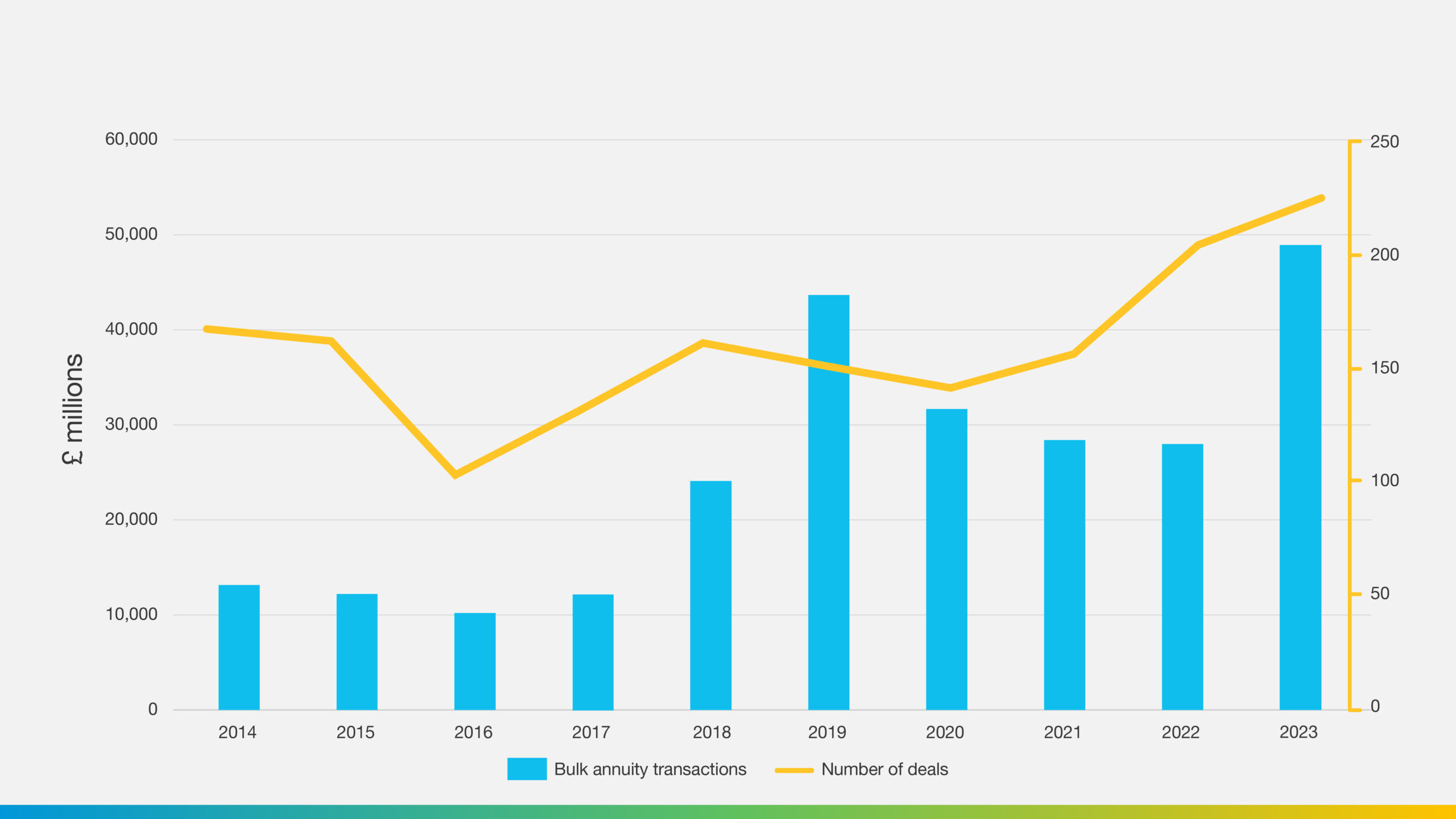

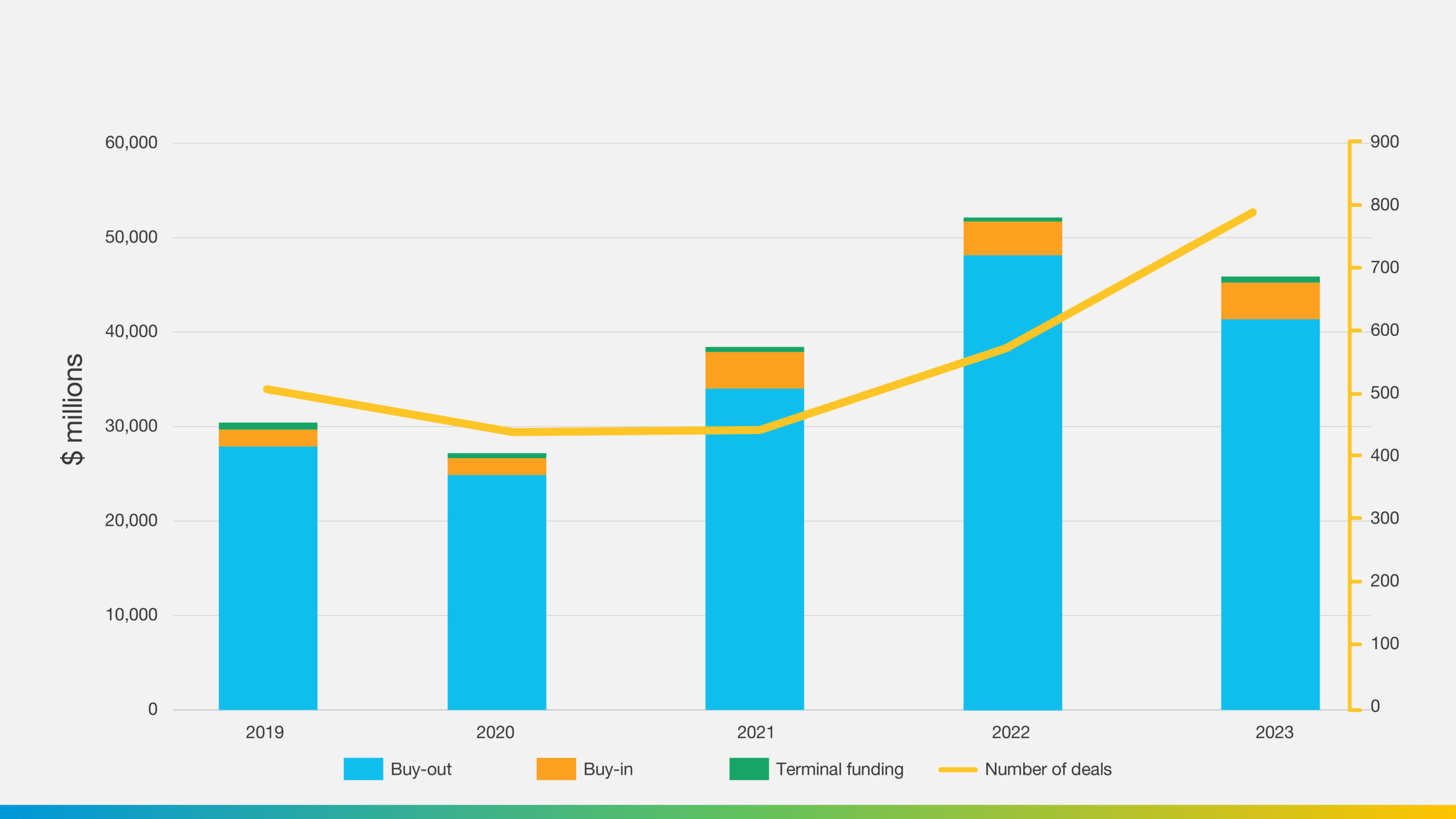

Number and value of transactions

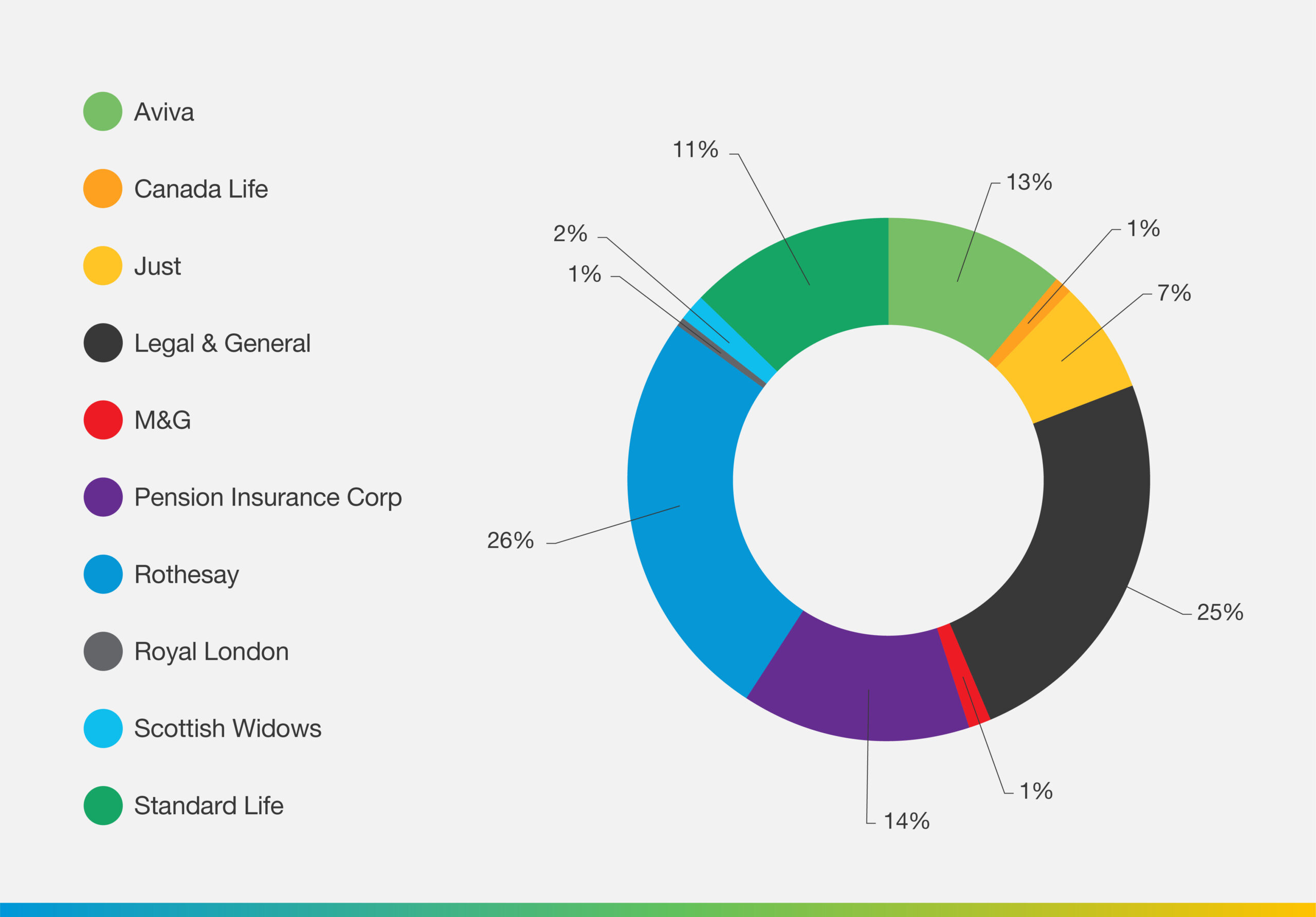

Insurer 2023 market share (by transaction value)

|

|||

|

Canada |

Philippe Rickli |

||

|

|

|

||

|

Snapshot

|

|||

|

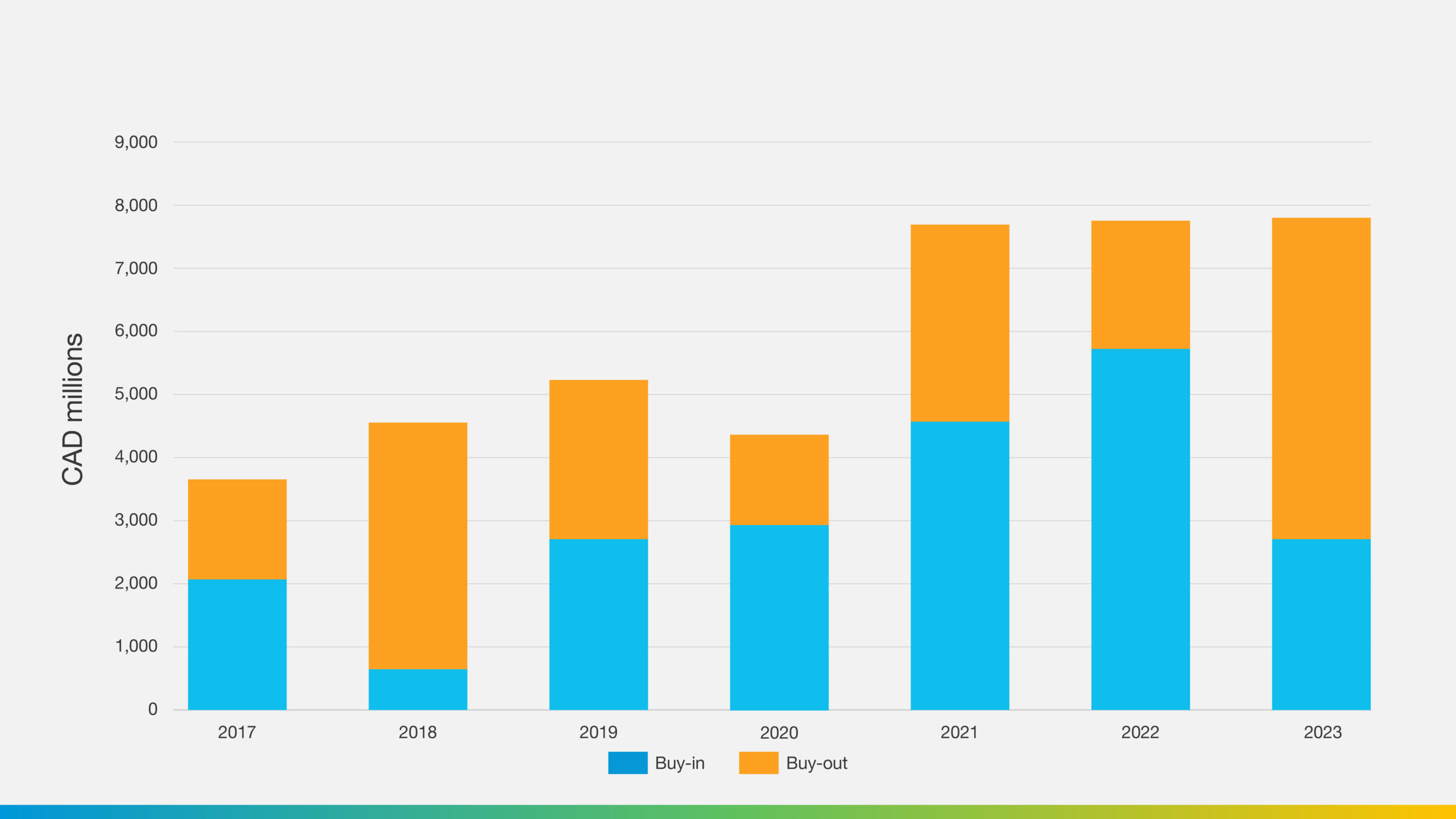

Value of transactions

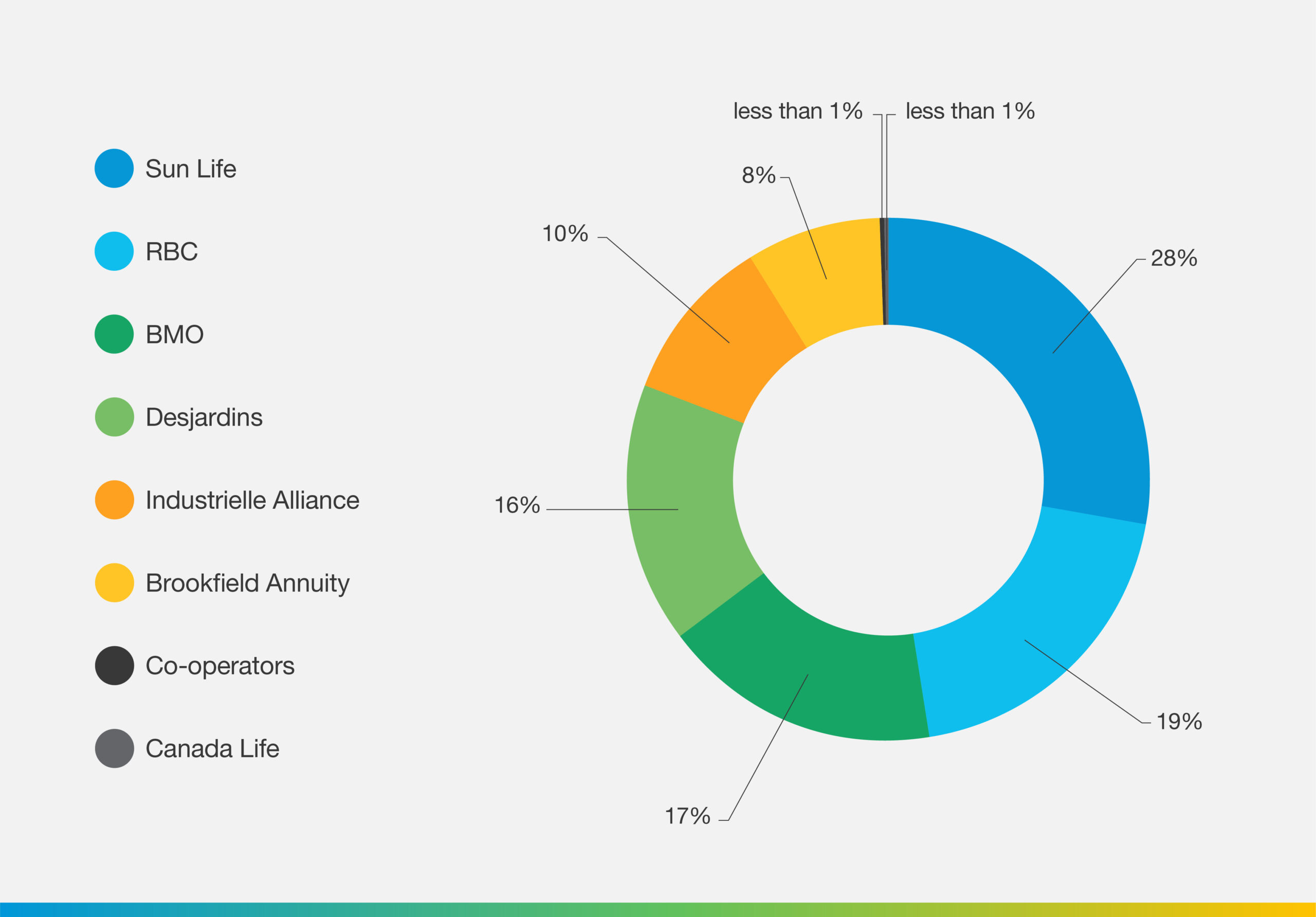

Insurer 2023 market share (by transaction value)

|

|||

|

USA |

Jake Pringle |

||

|

|

|

||

|

Snapshot

Number and value of transactions

|

|||

|

Germany |

Thomas Huth |

||

|

|

|

||

|

Snapshot

|

|||

For more information on the latest developments, to review your global pension risk transfer strategy or for advice on de-risking your pension plans, please contact Isabel Coles or your local MBWL consultant.

For a deeper dive, join MBWL experts for a discussion of this topic during our webinar on Wednesday, October 16 from 2:00 p.m. – 3:00 p.m. BST / 9:00 a.m. – 10:00 a.m. ET. To register, click here.

Contacts

Isabel Coles

Head of International Consulting, MBWL International

VIEW PROFILE

Email:

isabel.coles@mbwl-int.com

Tel: +44 20 3949 5710

Isabel Coles

Head of International Consulting, MBWL International

A multilingual expert in employee benefits for multinational corporates.

Isabel heads up MBWL International, advising multinational organisations on their employee benefits arrangements around the world, with a focus on corporate sales and purchases, accounting disclosures and the financing, risk management and design of benefit plans.

Her vast experience includes leading global accounting consolidations under international, UK and US accounting standards for multinational companies headquartered in the UK and overseas – with consolidations ranging in size from two to over 50 defined benefit plans.

She has advised both corporate and private equity buyers on the employee benefit considerations (including pension liabilities) associated with corporate sales and purchases in Europe and worldwide, from due diligence through to closing and subsequent integration work. Isabel has also undertaken many benefit audits and benchmarking exercises, including a 25-country audit for a company in the technology sector.

Other areas of Isabel’s expertise include reviewing and establishing international pension plans, advice on individual expatriate employee benefit packages and supporting multinationals in agreeing and implementing global governance approaches and policies for managing their employer benefit plans.

Isabel chairs the International Committee of the Association of Consulting Actuaries and is fluent in German and French.

Rosie Fantom

Partner, Head of Bulk Annuities and Risk Transfer, Barnett Waddingham

Philippe Rickli

Principal, Pension and Savings, Normandin Beaudry

Jake Pringle

Principal and Consulting Actuary, Milliman

Thomas Huth

Partner, Lurse

Contacts

Isabel Coles

Head of International Consulting, MBWL International

VIEW PROFILE

Email:

isabel.coles@mbwl-int.com

Tel: +44 20 3949 5710

Isabel Coles

Head of International Consulting, MBWL International

A multilingual expert in employee benefits for multinational corporates.

Isabel heads up MBWL International, advising multinational organisations on their employee benefits arrangements around the world, with a focus on corporate sales and purchases, accounting disclosures and the financing, risk management and design of benefit plans.

Her vast experience includes leading global accounting consolidations under international, UK and US accounting standards for multinational companies headquartered in the UK and overseas – with consolidations ranging in size from two to over 50 defined benefit plans.

She has advised both corporate and private equity buyers on the employee benefit considerations (including pension liabilities) associated with corporate sales and purchases in Europe and worldwide, from due diligence through to closing and subsequent integration work. Isabel has also undertaken many benefit audits and benchmarking exercises, including a 25-country audit for a company in the technology sector.

Other areas of Isabel’s expertise include reviewing and establishing international pension plans, advice on individual expatriate employee benefit packages and supporting multinationals in agreeing and implementing global governance approaches and policies for managing their employer benefit plans.

Isabel chairs the International Committee of the Association of Consulting Actuaries and is fluent in German and French.

Rosie Fantom

Partner, Head of Bulk Annuities and Risk Transfer, Barnett Waddingham

Philippe Rickli

Principal, Pension and Savings, Normandin Beaudry

Jake Pringle

Principal and Consulting Actuary, Milliman

Thomas Huth

Partner, Lurse