Global DB Pension Risk and Accounting Update

Where are DB Pensions heading into 2023?

2022 was a turbulent year for financial markets and global pension funding. Inflationary pressures and geopolitical instability set the backdrop for a steep increase in interest rates by central banks, reversing the direction of over a decade of monetary policy decisions.

In this article we look at what the financial market changes meant for pension plans over 2022 and the key global pension issues that multinationals are focusing on in 2023 – from an accounting, risk, funding and regulatory perspective.

Pension plans worldwide remain significant and complex to manage for many multinationals.

“Taking a fresh and independent look at all aspects of your global pension arrangements – from de-risking, funding and investments, to effective accounting and administration – can identify real value at a time when organizations and finance leaders need it most.”

Shrinking pension liabilities and improved funded status

Multinationals sponsoring defined benefit (DB) pension plans around the world have seen improvements in their net pension liability on the balance sheet under IFRS. Corporate bonds rose significantly over the year, leading to significantly higher discount rates and a corresponding reduction in international accounting liability values. This reduction in liability values generally outweighed the negative asset performance over the year, meaning the net position is likely to have improved for most plans. Balance sheet risk has also reduced as pension plan liabilities will now be substantially smaller in value terms.

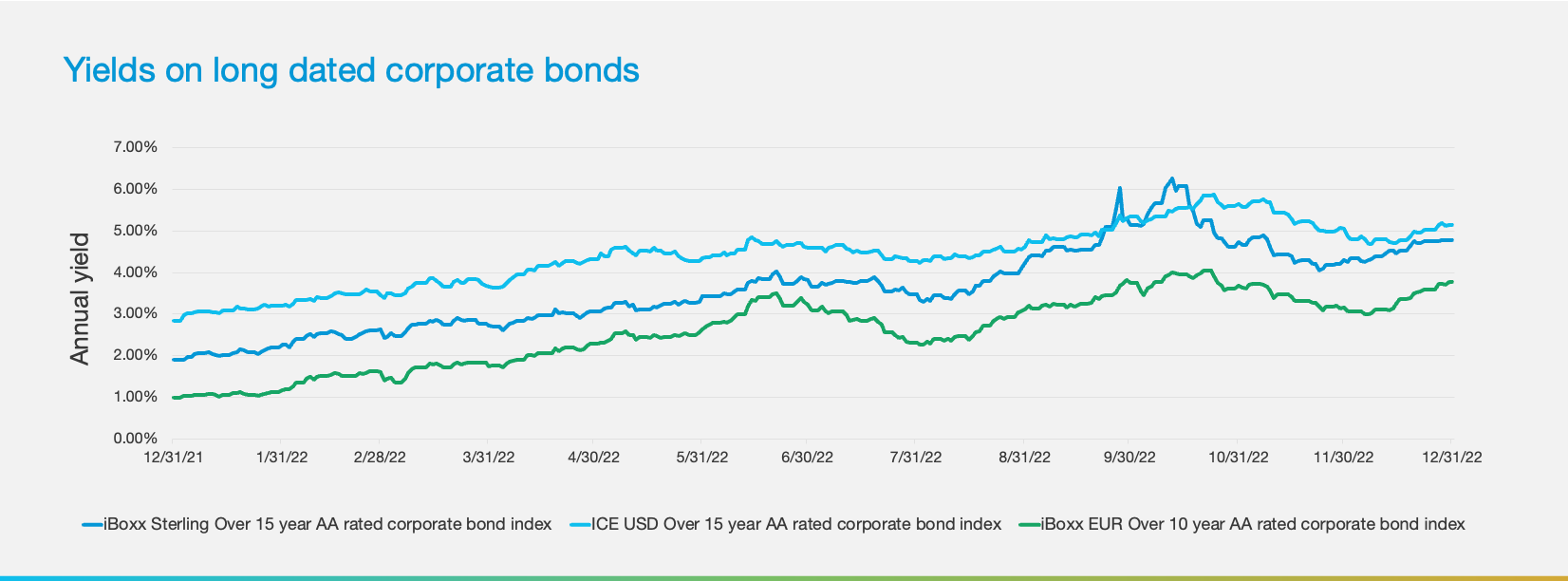

Yields on AA-rated Sterling, US Dollar and Euro denominated corporate bond rose significantly throughout the year, as illustrated in the chart below. As a result, discount rates for IFRS and US GAAP accounting purposes for DB plans in the UK, US and Eurozone at the end of 2022 were 2%-3% p.a. higher than at the start of the year. Rates were volatile during the year too and included a dramatic spike in UK yields around the time of the mini-budget and heightened political uncertainty in the UK in September.

Whilst inflation rates in the short term have been higher across many major jurisdictions, it is long term expectations for future inflation that are most relevant to pension plans globally. We have seen some impact of higher inflation in the short term (e.g. inflation-linked pension indexation in the UK and the Netherlands, or the knock on effects of inflationary salary increases required under collective agreements, such as in Belgium). However, the impact on longer term inflation expectations has been relatively modest and has generally been outweighed by the reductions in liability values due to the higher discount rates.

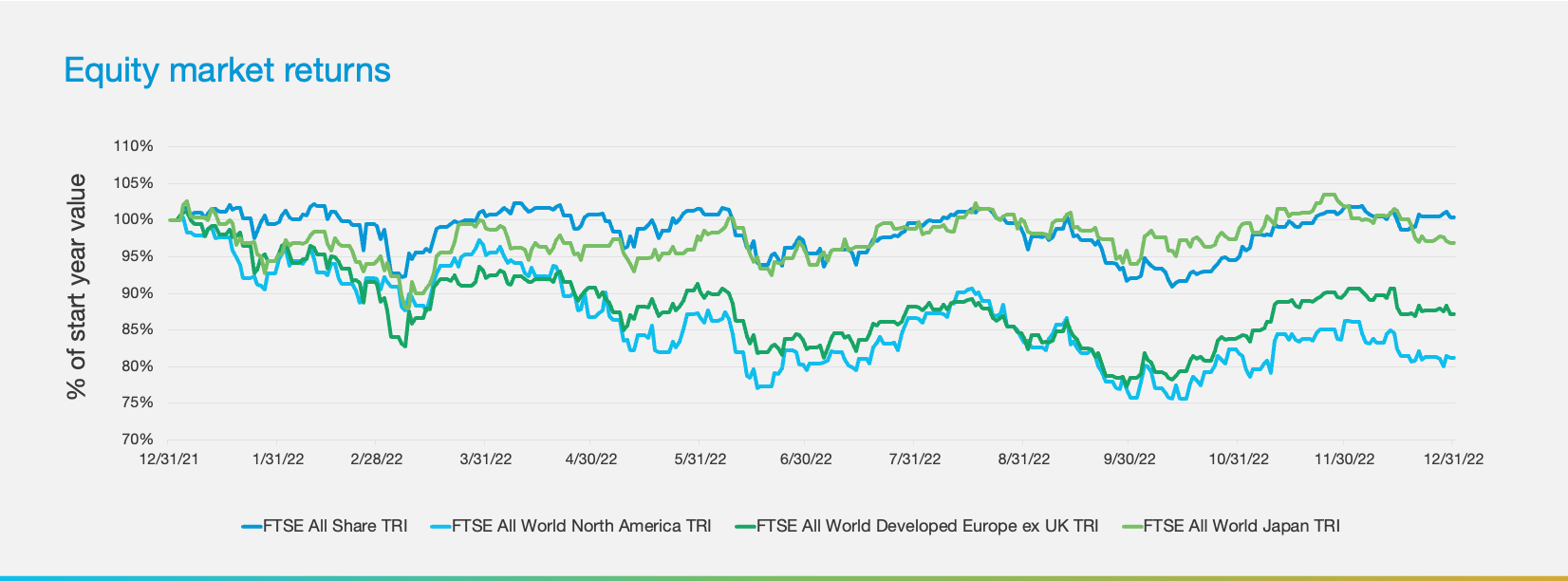

The performance of global equity markets was volatile over the year and varied significantly by country. For example, the UK equity market was slightly up over the year, whereas there was a sharp decrease in the US equity market, primarily driven by the downturn in technology stocks.

By the end of 2022, IFRS and US GAAP balance sheet liabilities for pension plans around the world had reduced significantly, due largely to the significant increases to discount rates noted above. For example:

- We observed pension plan liabilities in Germany reduce by 25-40% under IFRS. These plans are typically unfunded, so these reductions in liability led to equivalent reductions in balance sheet liabilities (and “funded status”). We note, however, that this effect is not mirrored for local GAAP (HGB) purposes as the discount rate for the HGB balance sheet averages market rates over the last 120 months, so yields will need to remain at the current higher levels for some time before the effect is felt.

- In the UK, a typical DB plan (with a 15-year liability duration and ca. 75% of the liabilities hedged for interest rate movements) would expect to have seen its IFRS liabilities reduce by 30-40%, and its overall funding position improve by 5-10% by the end of 2022.

- In the US, our Milliman 100 Pension Fund Index (tracking the 100 largest corporate DB pension plans) reported a funded ratio of 110.0% at the end of December 2022, up from 97.9% at the end of 2021, with total liabilities across these plans decreasing by $493 billion over the year due to the discount rate increases.

Important trends for employers

Closer monitoring and control of global pension accounting positions

2022 showed that pension plans globally continue to face significant risk and volatility – and opportunities. We observe global employers monitoring their plans more closely at a global level, often as part of a robust global accounting process. This includes more frequent measurement of funded status and reporting, and thorough reviews of assumptions to support more proactive governance and decision making.

Pension buyout opportunities are greater than ever

With improved funding levels, many employers are closer to being able to terminate their DB pension plans than ever. For example, according to Barnett Waddingham’s DB End Gauge index, the average time to buyout for the FTSE350 DB plans in the UK halved over 2022 – from 10.1 to 5.1 years.

The general increase in interest rates has created opportunities for annuity purchases. For example, research by our Canadian partners, Normandin Beaudry, shows that in Canada current annuity rates are similar to the IAS19 discount rates used by reporting entities in their financial statements. This implies that annuities can be purchased with little or even no adverse impact on the balance sheet, which creates opportunities for plan sponsors to transfer risks to an insurer. And in the US, the Milliman Pension Buyout Index indicates that the estimated competitive retiree buyout cost was 100.3% of the accounting liability in December 2022 (having been as low as 97.7% during April 2022).

We are also observing increasing interest in pension de-risking in markets where this had not been prevalent before. For example, in our webinar with Eversheds Sutherland last year, we discussed growing opportunities for pension de-risking and buyouts in the Netherlands, triggered by the significant Pension Reforms there, alongside growing interest from employers (typically global) and insurers in pension buyouts.

Understanding your investment risks

While funding levels broadly improved during 2022, market volatility put major stress on many pension plans. For example, turmoil in the UK’s liability driven investment (LDI) market in September caused many employers to re-assess how effective and robust their investment strategies are. In Canada, the federal government announced that it would immediately stop issuing Real Return Bonds (RRB) due to low demand – leaving pension plan sponsors needing to find alternative tools to hedge against inflation risk, a growing concern for plans offering indexed benefits. Variations in funding level movements in different countries led others to try to understand differences in asset allocation and hedging across countries, and re-assess whether those differences were still appropriate from a global perspective.

Moreover, many global employers for whom pension de-risking is a strategic imperative, are seeing recent developments as impetus to explore pension de-risking on a more globally consistent and proactive basis, including in countries such as Singapore, Malaysia, Turkey and Norway. We expect this trend to continue.

Keeping on top of legislative changes

As ever, pension regulation around the world continues to evolve and have a significant impact on plan sponsors. For example, in the UK the Pensions Regulator published its long-awaited second consultation on a revised Funding Code of Practice for Defined Benefit Pension Schemes in December 2022 – which could have a significant impact on plan funding requirements. Barnett Waddingham’s webinar with the UK Pensions Regulator discusses the wide-ranging implications of the proposals.

Unfreezing pension plans?

In the US, we are starting to observe some plan sponsors take a different view of improved funding levels (and lower DB pension costs) and explore the possibility of unfreezing their DB pension plans. These plan sponsors see DB plans as a critical element to their employee value proposition. Our recent Milliman article explores this trend further.

Clearly the impact of these trends will vary by employer and plan. However, given the significant changes over 2022, and the issues and opportunities for many companies globally, we highly recommend clients take the time and advice required to ensure they fully understand the issues and opportunities facing them. Moreover, many strategies require much due preparation, analysis and clear decision-making protocols in order to execute successfully.

A time to act

The close of the financial year is an ideal time for finance teams to reflect and take a fresh look at their global pension arrangements. This can start by looking at the global accounting process and year-end results, which should be the foundation of strong, proactive pension plan management globally, and support proactive prioritisation and decision making worldwide with regard to de-risking, investment, funding, design etc. Important questions to ask include:

- Was our global accounting process as smooth as it could be? Any surprises?

- Did the company feel that it had transparency and control of the process?

- Is there a more coherent, consistent approach to setting assumptions and monitoring funding levels, and market trends and opportunities?

- How are we sufficiently tracking our key pension risks and priorities? For example, are we now closer to plan termination in material countries than we were a year ago? Are we as prepared as we should be to take decisive de-risking action?

- Based on year-end results and business priorities, what should our priorities for pensions be in 2023? Have they changed? And what action should we take?

Answering these questions will help identify the steps you can take to ensure you are well-placed to seize the opportunities open to you in 2023 and beyond. For more information or to discuss any of the topics in this article, please contact John-Paul Augeri or Isabel Coles or your local MBWL consultant.

Contacts

Isabel Coles

Head of International Consulting, MBWL International

VIEW PROFILE

Email:

isabel.coles@mbwl-int.com

Tel: +44 20 3949 5710

Isabel Coles

Head of International Consulting, MBWL International

A multilingual expert in employee benefits for multinational corporates.

Isabel heads up MBWL International, advising multinational organisations on their employee benefits arrangements around the world, with a focus on corporate sales and purchases, accounting disclosures and the financing, risk management and design of benefit plans.

Her vast experience includes leading global accounting consolidations under international, UK and US accounting standards for multinational companies headquartered in the UK and overseas – with consolidations ranging in size from two to over 50 defined benefit plans.

She has advised both corporate and private equity buyers on the employee benefit considerations (including pension liabilities) associated with corporate sales and purchases in Europe and worldwide, from due diligence through to closing and subsequent integration work. Isabel has also undertaken many benefit audits and benchmarking exercises, including a 25-country audit for a company in the technology sector.

Other areas of Isabel’s expertise include reviewing and establishing international pension plans, advice on individual expatriate employee benefit packages and supporting multinationals in agreeing and implementing global governance approaches and policies for managing their employer benefit plans.

Isabel chairs the International Committee of the Association of Consulting Actuaries and is fluent in German and French.

John-Paul (JP) Augeri

Managing Director and Global EB Consulting Leader, Milliman

VIEW PROFILE

Email:

johnpaul.augeri@milliman.com

Tel: +1 347 541 1146

John-Paul (JP) Augeri

Managing Director and Global EB Consulting Leader, Milliman

A global human capital and risk management leader with wide-ranging technical and management experience.

JP joined Milliman to lead the Global Employee Benefits Consulting Practice, in partnership with MBWL. He has over twenty years’ experience helping multinational clients to design, deliver and manage programs globally across pensions, benefits and M&A. He specialises in solving complex global issues and delivering value and innovation to multinationals and their employees.

His expertise includes: global pensions and benefits; M&A; funding, investment, and derisking strategies; change management; total rewards and employee experience; global client management and business development.

He has also served as a board chair and senior advisor, as is a frequent external speaker who has helped lead several client roundtables.

JP is a Fellow of the Institute of Actuaries in the UK, and he has lived and worked in the US, UK, Germany, and Austria.

Contacts

Isabel Coles

Head of International Consulting, MBWL International

VIEW PROFILE

Email:

isabel.coles@mbwl-int.com

Tel: +44 20 3949 5710

Isabel Coles

Head of International Consulting, MBWL International

A multilingual expert in employee benefits for multinational corporates.

Isabel heads up MBWL International, advising multinational organisations on their employee benefits arrangements around the world, with a focus on corporate sales and purchases, accounting disclosures and the financing, risk management and design of benefit plans.

Her vast experience includes leading global accounting consolidations under international, UK and US accounting standards for multinational companies headquartered in the UK and overseas – with consolidations ranging in size from two to over 50 defined benefit plans.

She has advised both corporate and private equity buyers on the employee benefit considerations (including pension liabilities) associated with corporate sales and purchases in Europe and worldwide, from due diligence through to closing and subsequent integration work. Isabel has also undertaken many benefit audits and benchmarking exercises, including a 25-country audit for a company in the technology sector.

Other areas of Isabel’s expertise include reviewing and establishing international pension plans, advice on individual expatriate employee benefit packages and supporting multinationals in agreeing and implementing global governance approaches and policies for managing their employer benefit plans.

Isabel chairs the International Committee of the Association of Consulting Actuaries and is fluent in German and French.

John-Paul (JP) Augeri

Managing Director and Global EB Consulting Leader, Milliman

VIEW PROFILE

Email:

johnpaul.augeri@milliman.com

Tel: +1 347 541 1146

John-Paul (JP) Augeri

Managing Director and Global EB Consulting Leader, Milliman

A global human capital and risk management leader with wide-ranging technical and management experience.

JP joined Milliman to lead the Global Employee Benefits Consulting Practice, in partnership with MBWL. He has over twenty years’ experience helping multinational clients to design, deliver and manage programs globally across pensions, benefits and M&A. He specialises in solving complex global issues and delivering value and innovation to multinationals and their employees.

His expertise includes: global pensions and benefits; M&A; funding, investment, and derisking strategies; change management; total rewards and employee experience; global client management and business development.

He has also served as a board chair and senior advisor, as is a frequent external speaker who has helped lead several client roundtables.

JP is a Fellow of the Institute of Actuaries in the UK, and he has lived and worked in the US, UK, Germany, and Austria.