Global pension accounting snapshot – 31 March 2025

This note sets out some of the key issues for those involved in global defined benefit (DB) pension plan accounting.

Key trends over Q1 2025

- Movements in corporate bonds yields varied over the quarter to 31 March 2025 in the major economies. The UK, Eurozone, Indonesia, and China all saw increases in corporate bonds yields over the quarter. In contrast, corporate bonds yields marginally decreased in the USA, Canada and India.

- Since the start of the year there has been a significant drop in performance in the US equity market which has been driven by the trade tariffs and geopolitical uncertainty. Corporates with funded DB pension plans in the USA can expect a worsening in their net balance sheet position as at 31 March 2025 compared to 31 December 2024.

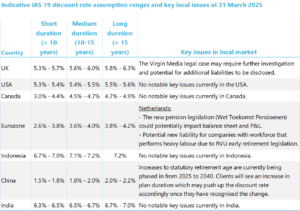

Discount rate assumptions and key local issues

The table below shows IAS 19 discount rate assumption ranges at 31 March 2025 that we typically expect in several key DB pension markets globally, as well as some of the key pension accounting issues in those countries.

If you would like to discuss the above in further detail or would like insights for any other countries, please get in touch.

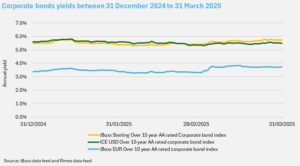

Movement in corporate bond yields

The chart below shows the change in the yields on AA-rated Sterling, US Dollar and Euro denominated corporate bonds over the quarter to 31 March 2025.

Since 31 December 2024, there has been a c. 0.3% increase in corporate bonds yields in the UK and the Eurozone. However, corporate bonds yields have marginally decreased in the US over the last quarter. Multinationals are likely to see a reduction in DB liability values in the UK and the Eurozone but an increase in DB liability values in the USA compared to the position at 31 December 2024.

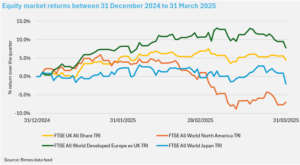

Growth asset performance

The chart below shows the performance of equity markets in the UK, US, Europe and Japan over the quarter to 31 March 2025.

Equity markets in the UK and Europe performed positively over the quarter to 31 March 2025, experiencing a 5% and 8% return, respectively.

However, the US equity market experienced significant volatility over the quarter. After an initial positive return in the first two months of the year, there has been a very significant drop in performance driven by geopolitical issues including trade policies and international relations, which has created uncertainty and affected investor sentiment. Funded DB plans in the USA with growth-oriented investment strategies are likely to have seen a drop in their asset values as at 31 March 2025 compared to the position at 31 December 2024.

Contacts

Isabel Coles

Head of International Consulting, MBWL International

VIEW PROFILE

Email:

isabel.coles@mbwl-int.com

Tel: +44 20 3949 5710

Isabel Coles

Head of International Consulting, MBWL International

A multilingual expert in employee benefits for multinational corporates.

Isabel heads up MBWL International, advising multinational organisations on their employee benefits arrangements around the world, with a focus on corporate sales and purchases, accounting disclosures and the financing, risk management and design of benefit plans.

Her vast experience includes leading global accounting consolidations under international, UK and US accounting standards for multinational companies headquartered in the UK and overseas – with consolidations ranging in size from two to over 50 defined benefit plans.

She has advised both corporate and private equity buyers on the employee benefit considerations (including pension liabilities) associated with corporate sales and purchases in Europe and worldwide, from due diligence through to closing and subsequent integration work. Isabel has also undertaken many benefit audits and benchmarking exercises, including a 25-country audit for a company in the technology sector.

Other areas of Isabel’s expertise include reviewing and establishing international pension plans, advice on individual expatriate employee benefit packages and supporting multinationals in agreeing and implementing global governance approaches and policies for managing their employer benefit plans.

Isabel chairs the International Committee of the Association of Consulting Actuaries and is fluent in German and French.

Elliot Colman

Global Benefits Consultant

VIEW PROFILE

Email:

elliot.colman@mbwl-int.com

Tel: +44 (0) 20 3949 5711

Elliot Colman

Global Benefits Consultant

Elliot is a Global Benefits Consultant for MBWL and is based in London. He joins MBWL from PwC where he started his career over 7 years’ ago. He has experience working as both a corporate pensions actuary before moving into a M&A team specialising in global defined benefit plans.

He brings expertise in advising both large multinational companies and private equity firms on global defined benefit plans, equity plans, and other employee related issues over the course of a deals cycle, including buy-side and vendor due diligence and bespoke strategic advice for sale.

Elliot graduated from the University of Nottingham with a first-class degree in BSc (Hons) Financial Mathematics and is a Fellow of the Institute of Actuaries in the UK.

Contacts

Isabel Coles

Head of International Consulting, MBWL International

VIEW PROFILE

Email:

isabel.coles@mbwl-int.com

Tel: +44 20 3949 5710

Isabel Coles

Head of International Consulting, MBWL International

A multilingual expert in employee benefits for multinational corporates.

Isabel heads up MBWL International, advising multinational organisations on their employee benefits arrangements around the world, with a focus on corporate sales and purchases, accounting disclosures and the financing, risk management and design of benefit plans.

Her vast experience includes leading global accounting consolidations under international, UK and US accounting standards for multinational companies headquartered in the UK and overseas – with consolidations ranging in size from two to over 50 defined benefit plans.

She has advised both corporate and private equity buyers on the employee benefit considerations (including pension liabilities) associated with corporate sales and purchases in Europe and worldwide, from due diligence through to closing and subsequent integration work. Isabel has also undertaken many benefit audits and benchmarking exercises, including a 25-country audit for a company in the technology sector.

Other areas of Isabel’s expertise include reviewing and establishing international pension plans, advice on individual expatriate employee benefit packages and supporting multinationals in agreeing and implementing global governance approaches and policies for managing their employer benefit plans.

Isabel chairs the International Committee of the Association of Consulting Actuaries and is fluent in German and French.

Elliot Colman

Global Benefits Consultant

VIEW PROFILE

Email:

elliot.colman@mbwl-int.com

Tel: +44 (0) 20 3949 5711

Elliot Colman

Global Benefits Consultant

Elliot is a Global Benefits Consultant for MBWL and is based in London. He joins MBWL from PwC where he started his career over 7 years’ ago. He has experience working as both a corporate pensions actuary before moving into a M&A team specialising in global defined benefit plans.

He brings expertise in advising both large multinational companies and private equity firms on global defined benefit plans, equity plans, and other employee related issues over the course of a deals cycle, including buy-side and vendor due diligence and bespoke strategic advice for sale.

Elliot graduated from the University of Nottingham with a first-class degree in BSc (Hons) Financial Mathematics and is a Fellow of the Institute of Actuaries in the UK.