Poland: Mandatory DC pension plans on the way

On 1 January 2019 legislation for the new mandatory, employer-sponsored pension plans (Pracownicze Plany Kapitałowe or “PPK”) came into force. From 1 July 2019, employers are required to set up and automatically enroll employees into a PPK.

Automatic enrolment applies to employees under age 55 who have completed three months of service with their employer. Participation in a PPK is voluntary, so employees can choose to opt out. However, employees who opt out must be automatically re-enrolled every four years. Employees aged 55 to 69 can participate in the plan on a voluntary basis.

PPKs are defined contribution plans and the PPK contributions are as follows:

| Mandatory Minimum Contributions | Voluntary Additional Contributions | |

| Employee | 2% of pay * | Up to an additional 2% of pay |

| Employer | 1.5% of pay | Up to an additional 2.5% of pay |

| State | One-off PLN 250 “welcome contribution”, plus an annual contribution set at PLN 240 for 2019 |

* Reduced to 0.5% of pay for employees earning less than 1.2 times the minimum wage.

The contributions will be invested with a PPK provider. Potential PPK providers include mutual investment funds, pension funds and insurance companies, with the state fund (PFR) as the default provider.

Providers are required to offer at least five approved investment funds – lifecycle funds targeted for retirements in certain years. As a default on joining the PPK, employees’ funds will be invested in the appropriate lifecycle fund based on their date of birth, but will be able to choose to change funds later on. The management charges for PPKs are relatively low compared to other forms of pension saving: annual investment management charges are limited to 0.5% of the net asset value of the fund, plus an annual performance-related fee of up to 0.1% of the net asset value of the fund (if the fund achieves a positive return and beats the benchmark).

At the age of 60, the plan participant is entitled to take 25% of the accumulated funds as a lump sum payment, and the remainder in monthly instalments over a 10-year period. Funds can also be withdrawn in other specific circumstances, for example:

- 25% of the fund can paid out in the event of serious illness of the plan participant, their spouse or their children

- For participants aged under 45, the accumulated funds can be withdrawn for a down payment for the purchase of a first home – this payment is a loan, and the funds need to be repaid to the PPK within 15 years.

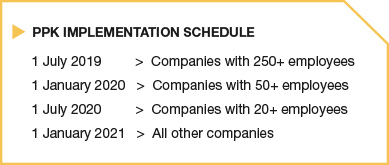

The new PPK requirements will be phased in, applying to companies with 250 or more employees from 1 July 2019. It will extend to all companies by January 2021.

The requirement to automatically enrol employees into a PPK is waived for employers who are already offering a qualifying PPE (Pracownicze Programy Emerytalne) – a voluntary occupational DC pension plan. To qualify for the exemption the PPE must be established before the mandatory PPK requirement applies to the employer, at least 25% of the workforce participate in the PPE and employer contributions are at least 3.5% of pay.

It is also worth noting that the legislation permits employers to offer both a PPK and a PPE (or in future to offer a PPE instead of a PPK, in consultation with trade union representatives). PPK and PPE are different types of arrangements with different features; for example, employees are not obliged to contribute to a PPE. Employers who already have a PPE or are interested in setting one up will wish to compare the two systems to allow them to choose the most appropriate arrangement(s) going forward.

Employers looking to set up a PPK to comply with the mandatory requirements also have a number of actions to complete before their PPK introduction deadline, including:

- analysing the potential impact of the new provisions on the company’s budget and payroll system

- discussions with relevant unions or employee representatives on the new plan

- identifying and evaluating the potential PPK providers, and selecting a provider for their plan

- communication with employees on the implementation of the PPK

While the introduction of the PPK requirements is being phased in with start dates varying depending on the size of the workforce, all employers should start preparing now by considering their options, potential budget impacts and planning for implementation.

Contacts

Isabel Coles

Head of International Consulting, MBWL International

VIEW PROFILE

Email:

isabel.coles@mbwl-int.com

Tel: +44 20 3949 5710

Isabel Coles

Head of International Consulting, MBWL International

A multilingual expert in employee benefits for multinational corporates.

Isabel heads up MBWL International, advising multinational organisations on their employee benefits arrangements around the world, with a focus on corporate sales and purchases, accounting disclosures and the financing, risk management and design of benefit plans.

Her vast experience includes leading global accounting consolidations under international, UK and US accounting standards for multinational companies headquartered in the UK and overseas – with consolidations ranging in size from two to over 50 defined benefit plans.

She has advised both corporate and private equity buyers on the employee benefit considerations (including pension liabilities) associated with corporate sales and purchases in Europe and worldwide, from due diligence through to closing and subsequent integration work. Isabel has also undertaken many benefit audits and benchmarking exercises, including a 25-country audit for a company in the technology sector.

Other areas of Isabel’s expertise include reviewing and establishing international pension plans, advice on individual expatriate employee benefit packages and supporting multinationals in agreeing and implementing global governance approaches and policies for managing their employer benefit plans.

Isabel chairs the International Committee of the Association of Consulting Actuaries and is fluent in German and French.

Contacts

Isabel Coles

Head of International Consulting, MBWL International

VIEW PROFILE

Email:

isabel.coles@mbwl-int.com

Tel: +44 20 3949 5710

Isabel Coles

Head of International Consulting, MBWL International

A multilingual expert in employee benefits for multinational corporates.

Isabel heads up MBWL International, advising multinational organisations on their employee benefits arrangements around the world, with a focus on corporate sales and purchases, accounting disclosures and the financing, risk management and design of benefit plans.

Her vast experience includes leading global accounting consolidations under international, UK and US accounting standards for multinational companies headquartered in the UK and overseas – with consolidations ranging in size from two to over 50 defined benefit plans.

She has advised both corporate and private equity buyers on the employee benefit considerations (including pension liabilities) associated with corporate sales and purchases in Europe and worldwide, from due diligence through to closing and subsequent integration work. Isabel has also undertaken many benefit audits and benchmarking exercises, including a 25-country audit for a company in the technology sector.

Other areas of Isabel’s expertise include reviewing and establishing international pension plans, advice on individual expatriate employee benefit packages and supporting multinationals in agreeing and implementing global governance approaches and policies for managing their employer benefit plans.

Isabel chairs the International Committee of the Association of Consulting Actuaries and is fluent in German and French.