USA: Seven trends in compensation

With unemployment in the United States at a near 50-year low, employers need to find novel ways to attract new employees and keep their current workforce engaged. Even in a historically tight labor market, average annual adjustments to base salaries have remained relatively stagnant over the past five-plus years, at around 3.0% annually1. Therefore, creating competitive compensation packages that ensure employee satisfaction must reach beyond pay to more comprehensive views of what workers want from their companies and jobs.

From ensuring pay equity to creating a meaningful philosophy of corporate social responsibility (CSR), here are seven trends in compensation that are critical for employers to consider in the current labor market.

7. Engagement

Research has consistently shown that keeping employees engaged is the key to running a successful business. According to an analysis conducted by Gallup, business units with highly engaged employees achieve a 10% increase in customer ratings, a 20% increase in sales, and 21% greater profitability2.

The same Gallup report found that only 33% percent of Americans said they were engaged at work3. Another 16% reported being actively disengaged, while the remaining 51% lay somewhere in the middle—they reported neither liking nor disliking their jobs.

Engaged employees feel connected to their companies and are consistently willing to put in the extra effort in their jobs. But engagement is not just about productivity; it’s also about retaining your workforce, especially in a tight labor market.

In July 2018 the U.S. Bureau of Labor Statistics reported the highest turnover rate for private sector workers since they began conducting their Job Openings and Labor Turnover Survey (JOLTS) in 2000—and that rate hasn’t dropped according to its latest, April 2019 release4.

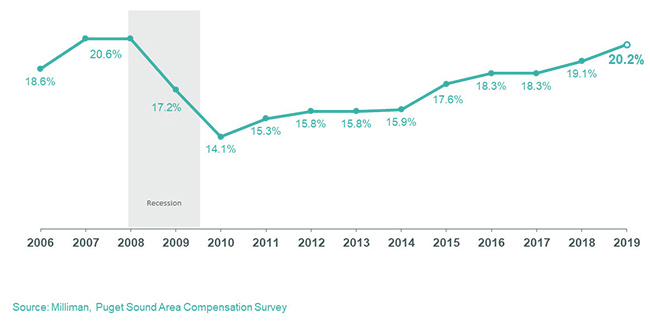

Milliman data from the Pacific Northwest region also highlights a pattern of higher turnover in recent years, as the unemployment rate has dropped to historic lows. In 2019, the annual turnover rate for workers across all industries in the Puget Sound metro area was 20.2%, up from 14.1% in 2010, almost reaching the 20.6% prerecession turnover rate recorded in this region in 2007 and 20085.

Turnover rates continue to rise

6. CSR

Millennials may be famous for wanting to derive purpose from their work, but most importantly workers—regardless of their generation—want to work for a company that supports their values. Developing a clear CSR philosophy is becoming critical to employers seeking to take ownership of their environmental, economic, and social impacts.

Companies can practice CSR in various ways, including:

Environmental sustainability initiatives aimed at reducing their carbon footprints

Philanthropic efforts aligned with corporate culture and employee interests

Initiatives to ensure the ethical and fair treatment of all employees

Volunteer opportunities (using paid work time) that benefit the community and/or reflect the company’s mission and employees’ passions

As companies continue to face evolving challenges like combating sexual harassment, promoting pay equity, and ensuring corporate ethics, an authentic and meaningful CSR strategy will be key to attracting, engaging, and retaining employees.

5. Pay equity

The list of states and localities enacting salary history bans to prevent pay discrimination continues to grow. Washington state is the latest to prohibit employers of all sizes from asking job candidates about their past pay, joining nearby Oregon and California. House Bill 1696, which amends the Equal Pay and Opportunities Act (EPOA), was signed by Governor Jay Inslee on May 9, 2019, and went into effect on July 28, 2019. Similar to California’s Equal Pay Act, the newly amended EPOA provides provisions to promote transparency, requiring employers with at least 15 employees to provide salary range or minimum salary information to external and internal applicants under certain circumstances6.

Aside from the question of legal compliance, perceptions of pay inequity erode employee engagement and trust in management. As pay equity legislation at large becomes more widespread, employers may need to reexamine their hiring practices, and rely more on market data and candidates’ qualifications when setting pay.

4. Minimum wage

In recent years, the effective minimum wage in some areas in the United States has outpaced inflation and grown even faster than typical wages. As of April 2019, 29 states and the District of Columbia had minimum hourly wages that were higher than the federal rate7. In Washington state, the minimum wage is now $12.00; Seattle, which has been one of the cities paving the way for higher minimum wages, now requires its large employers to pay $16.00.

As the minimum wage rises, companies can experience wage compression, where more senior employees (particularly those making slightly more than minimum wage) are no longer better compensated than less senior ones. Employers need to look at how employees making minimum wage fit into their overall pay structures, both to effectively budget for the increases and to make sure they won’t experience compression among different levels of their employees.

3. Hot jobs

Employers must also consider “hot jobs” when determining their total compensation budgets. Salaries for these positions are moving at a more rapid pace than the rest of the market. Employers must be aware of such trends to effectively determine compensation for current or prospective employees who hold these positions.

For example, according to data from the Portland Area Compensation Survey, the positions of payroll manager and accounting supervisor saw much greater average salary adjustments (approximately 6.7% and 6.8%, respectively) in the Portland metro area than the approximately 3% increase measured in the job market as a whole8. Quality benchmark survey data will be key to helping companies identify such hot jobs and adjusting compensation budgets accordingly.

2. Employee financial wellness/well-being

Like the desire for meaningful work, financial stress is not confined to one generation, gender, or even wage bracket, but affects a large percentage of the workforce. A recent survey by PricewaterhouseCoopers (PwC) found that 35% of working adults in the United States cited health issues caused by financial stress, while 48% of respondents said they were distracted by finances at work9.

Such results highlight the fact that employee financial wellness initiatives, like counseling and education aimed at budgeting, reducing debt, building wealth, and saving for retirement, stand to benefit a large population of employees. This may help alleviate some of their stress, allowing them to be more productive. According to the PwC survey, more than half the respondents (54%) said they wanted to make their own financial decisions, but wanted someone to validate those decisions; another 25% mentioned financial wellness benefits with access to unbiased counselors as the most desired employer benefit they didn’t have.

In addition to its effect on employee productivity, looking after employees’ financial well-being by offering such benefits as student loan repayment programs and reduced healthcare costs can also help increase engagement and reduce turnover.

1. Total rewards

Though salary is one of the most important drivers of employee attraction and retention, a company’s ability to attract and retain the best employees depends to a large extent on other pay components in the total rewards package. This is especially true as the cost of major benefits such as healthcare have increased, even as salary increases have stalled in recent years.

For employers, getting total rewards right comes down to understanding what employees really want from their jobs. In addition to base pay and incentive pay, health benefits, retirement plans, paid time off, and parental leave, other areas of a total rewards package include more intangible things like a company’s management style, mission, and culture. Encouraging work-life balance and fostering career and personal development is also important.

Given the lack of growth in salary budgets, these more intangible areas included within a comprehensive total rewards package can have a tremendous impact on a company’s ability to attract and engage employees.

- Milliman (2019). Puget Sound Area and Portland Area Compensation Surveys, Salary Trends (averages including zeros). The full report for the Puget Sound is available via https://www.salarysurveys.milliman.com/PugetSoundRegionalSalarySurvey. The full report for Portland is available via https://www.salarysurveys.milliman.com/PortlandAreaCrossIndustrySurvey.

- Harter, J. & Mann, A. (April 12, 2017). The Right Culture: Not Just About Employee Satisfaction. Gallup Retrieved June 27, 2019, from https://www.gallup.com/workplace/236366/right-culture-not-employee-satisfaction.aspx.

- Gallup. State of the American Workplace. Retrieved June 27, 2019, from https://news.gallup.com/reports/199961/7.aspx.

- U.S. Bureau of Labor Statistics (2019). Job Openings and Labor Turnover Survey. Retrieved June 27, 2019, from https://www.bls.gov/jlt/. Data extracted June 13, 2019.

- Milliman, Puget Sound Area Compensation Survey, op cit.

- Martell, B. & Hemenway, A. (May 16, 2019). Washington amends its Equal Pay Law to enact salary history ban and require disclosure of salary ranges. Littler. Retrieved June 27, 2019, from https://www.littler.com/publication-press/publication/washington-amends-its-equal-paylaw-enact-salary-history-ban-and.

- Tedeschi, E. (April 24, 2019). Americans are seeing highest minimum wage in history (without federal help). New York Times. Retrieved June 27, 2019, from https://www.nytimes.com/2019/04/24/upshot/why-america-may-already-have-its-highest-minimum-wage.html.

- Milliman, Portland Area Compensation Survey, op cit.

- PwC. PwC’s 8th annual Employee Financial Wellness Survey: 2019 results. Retrieved June 27, 2019, from https://www.pwc.com/us/en/industries/private-company-services/library/financial-well-being-retirement-survey.html.

Contacts

Lauren S Busey

Milliman

Contacts

Lauren S Busey

Milliman