2022 Global Benefits Client Survey Results

What do global organisations have in mind for their benefits in 2022, what are their priorities and what challenges do they face?

To find out, MBWL ran a global survey on key topics that are top of mind for benefits leaders at leading organisations worldwide, under three headings:

- ESG (Environmental, Social, Governance) – including topics such as climate, DE&I (Diversity, Equity and Inclusion) and oversight

- Talent and Growth – including topics such as the role of benefits in your EVP (Employee Value Proposition), and alignment with people and business objectives

- Maximising Value – including topics such as employee appreciation, performance and measurement, drivers for change, and cost and resources

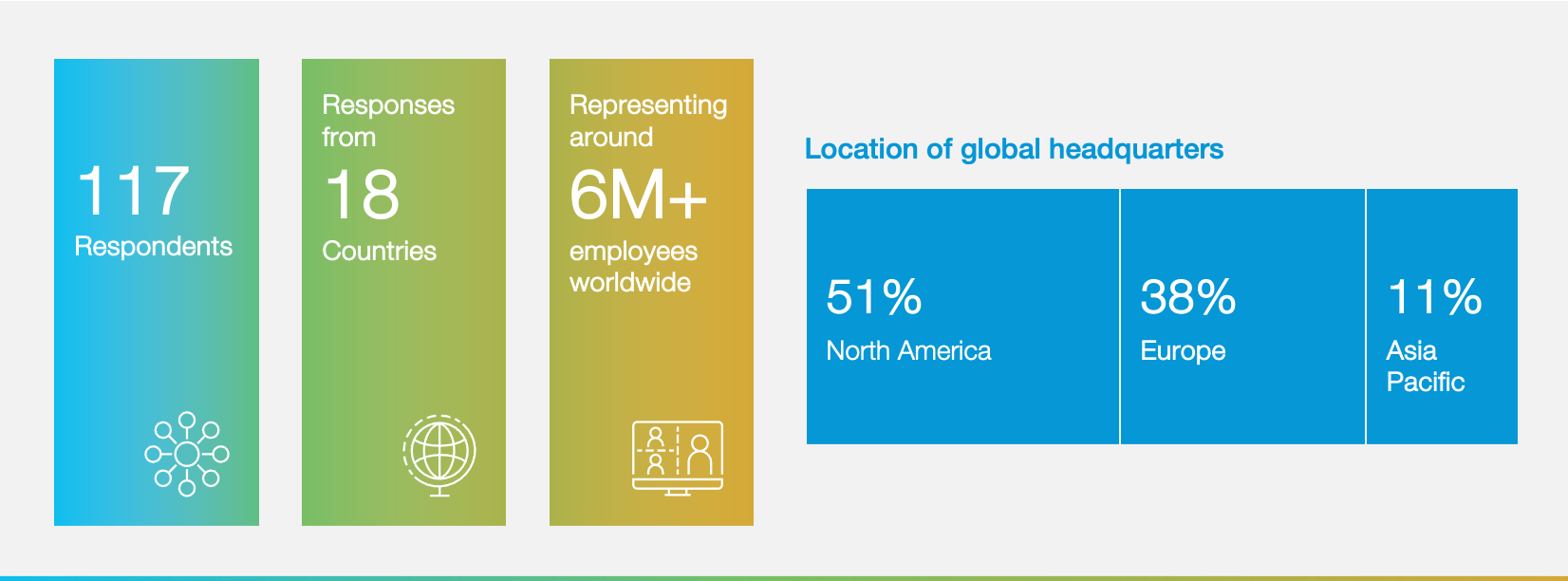

The survey was open from 25 January to 28 February 2022, with participation as follows:

We are excited to share our initial findings.

ESG is increasingly relevant to benefit strategy

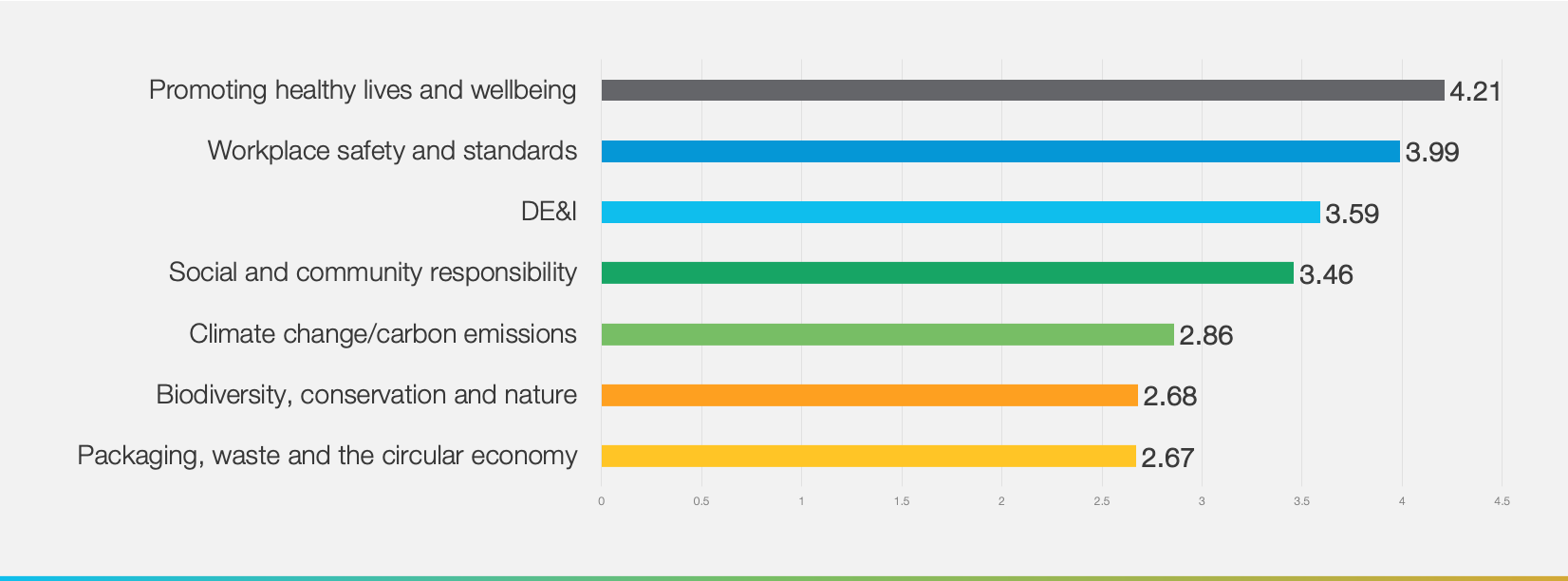

ESG considerations have been growing in importance across an organisation’s operations. When it comes to benefits strategy, the average score (based on a scale of 1 to 5) of the influence of seven ESG contributors were as follows:

Our point of view: It was not surprising that initiatives supporting employee wellbeing are top of mind for organisations – with promoting healthy lives and wellbeing and workplace safety and standards ranking highest. Whilst DE&I was the third highest contributor, it ranked slightly lower than we might have anticipated in light of the sustained focus on this area in recent years. This suggests that there may be more to be done to ensure that DE&I is fully considered in benefits strategy.

DE&I is important for benefits strategy

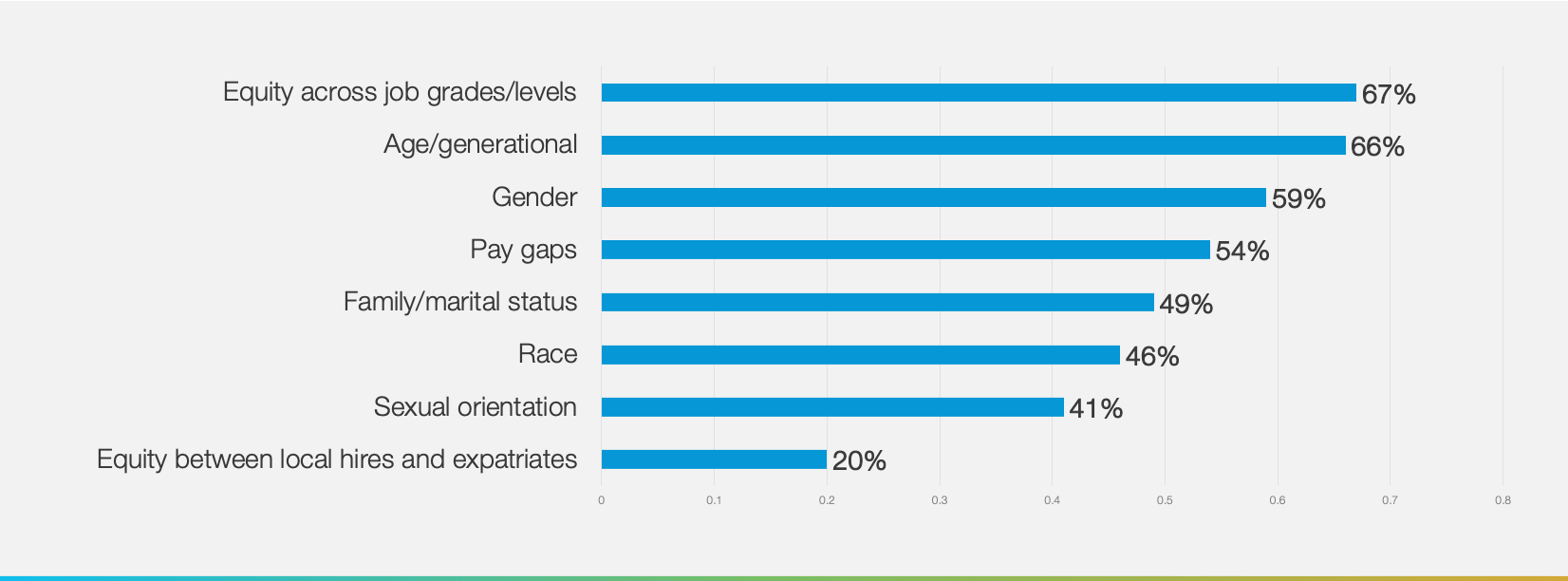

DE&I is a key consideration for many organisations when defining their employment deal with employees. We asked respondents to state which DE&I factors they consider when designing and managing benefits. Most factors saw high levels of relevance.

Two-thirds (67%) of respondents cited equity across job levels, making this the most important DE&I factor. Nearly as many respondents (66%) cited age/generational considerations as important.

Our point of view: We have seen a gradual shift away from benefits based on job levels. This is particularly true for healthcare/medical benefits where differentiated benefits had been common in many markets. It is hard to justify why the medical needs of a senior employee are any different to those of a junior employee.

Typically there is a strong correlation between job level and age so there may be some cross-over between these factors.

Designing benefits – cost and talent needs remain paramount

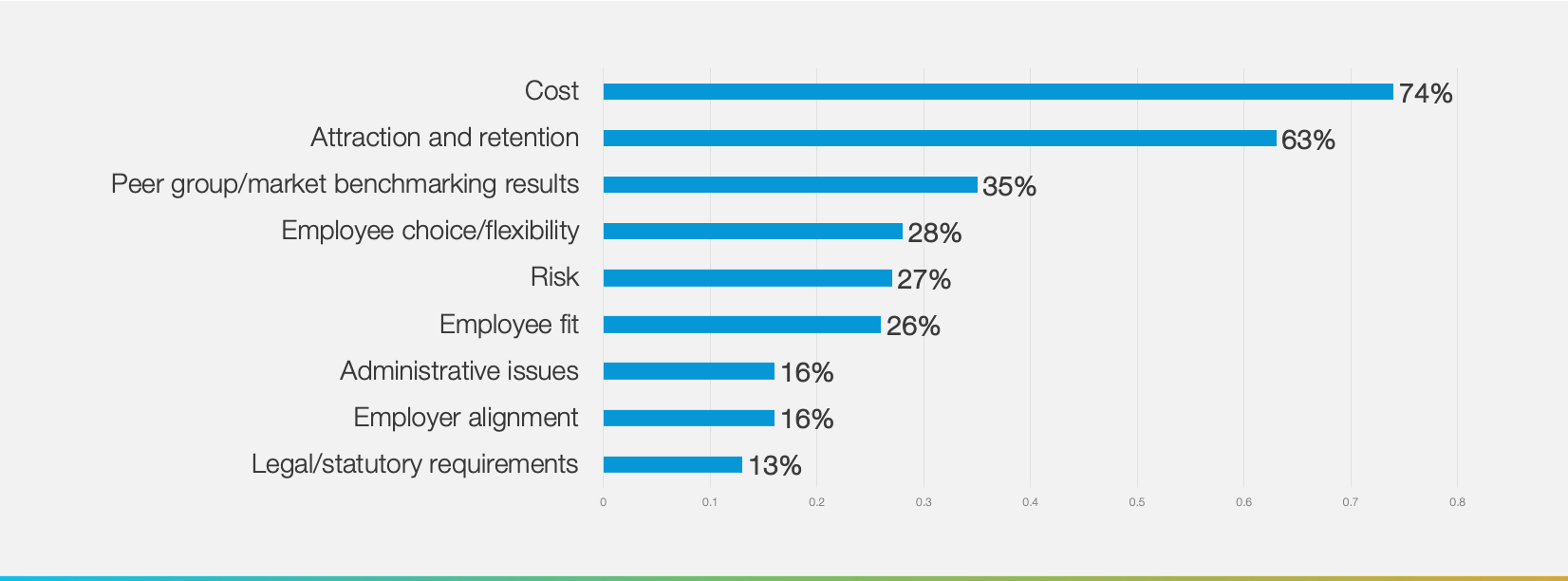

Cost is the most important aspect organisations consider when designing and reviewing benefits (74% of respondents). However, attraction and retention is a close second (63% of respondents), which is perhaps unsurprising given the tight talent market in many countries currently.

Benchmarking (35% of respondents) ranked as more important than either employee fit (26% of respondents) or employer alignment (16% of respondents).

Our point of view: Smart organisations tend to use benchmarking as just one of many inputs to support a benefits design that is tailored to their needs, rather than simply following their peers.

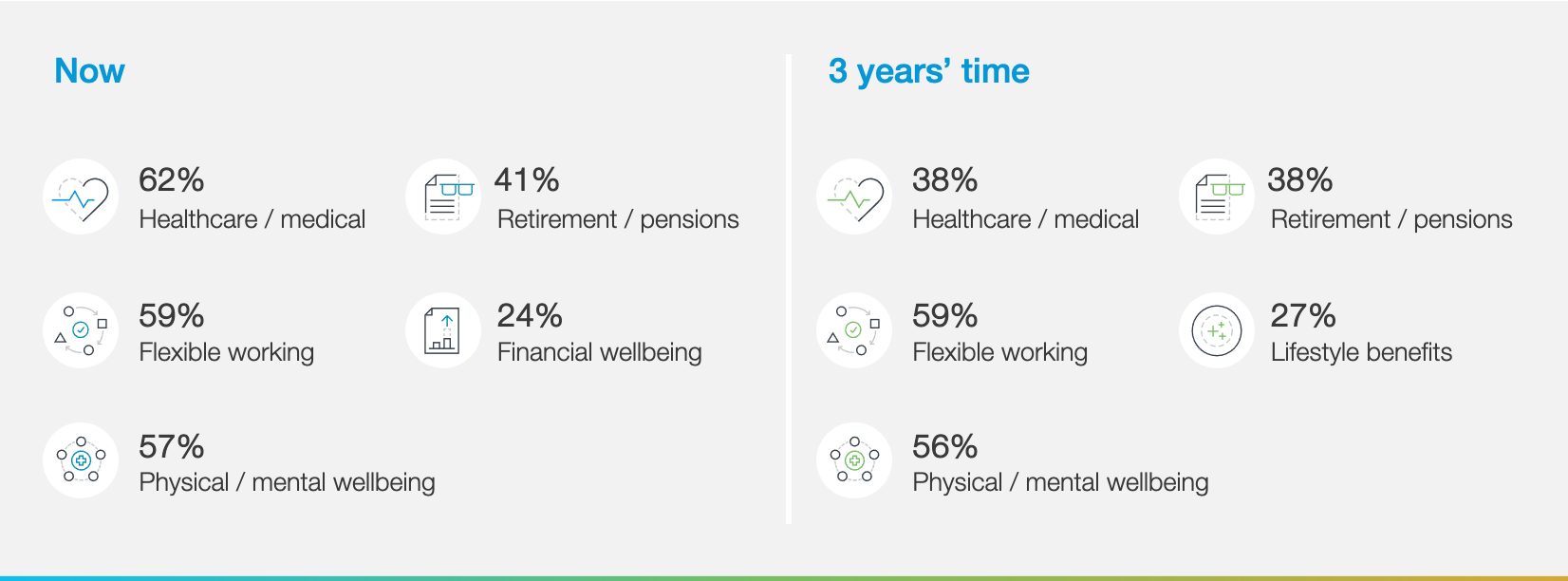

Healthcare/medical benefits are most important to both employees and employer

Healthcare/medical benefits are seen as both the most important benefit to employees (74% of respondents) and the most important for organisations’ EVP (62% of respondents).

Healthcare/medical benefits demand the most internal resource to manage – 49% of respondents cited it, which was even higher than retirement/pensions (46% of respondents) which have traditionally taken the most time given their complexity.

Our point of view: Whilst some of the recent focus on healthcare/medical benefits may have been driven by the COVID-19 pandemic, close scrutiny will continue to be needed in the future given expectations of significant medical cost inflation in the coming years.

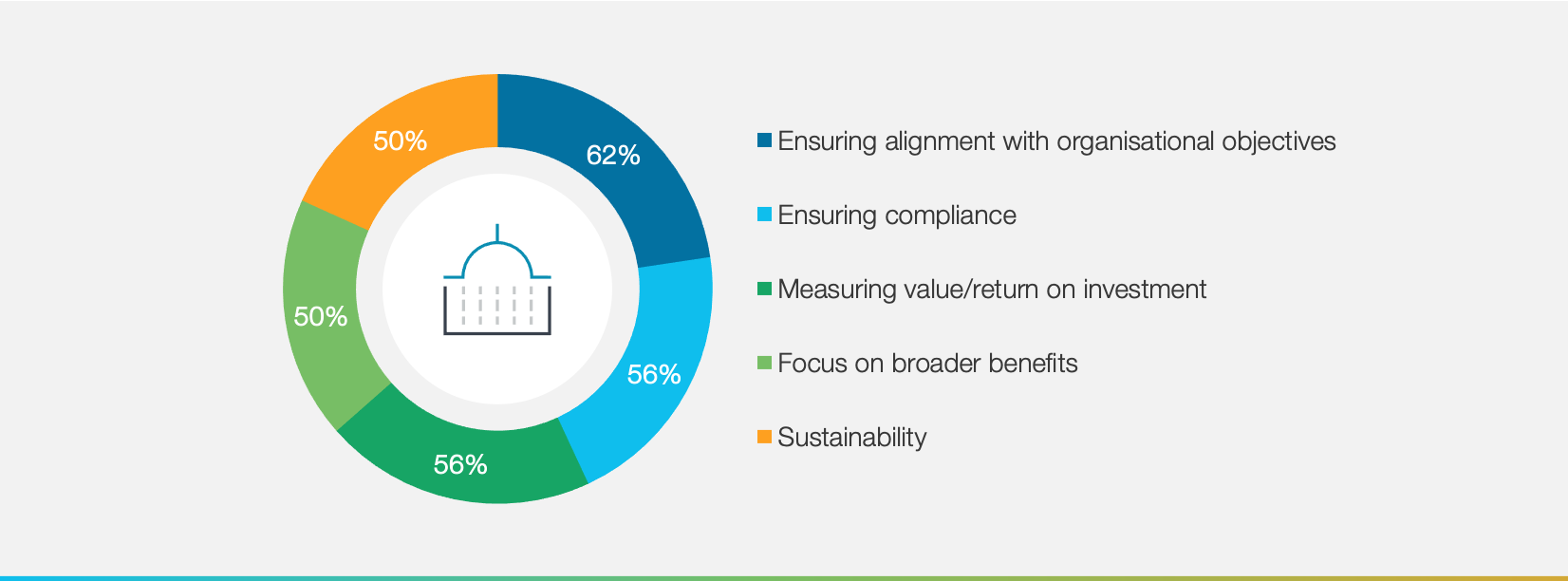

Global governance – an increasing focus on corporate priorities

Ensuring alignment of benefits with corporate objectives was the most important focus area in the governance of global benefits (62% of respondents), ranking even higher than ensuring compliance (56% of respondents). Organisations are clearly recognising the strategic importance of benefits globally.

Half (50%) of respondents said their global benefits governance focuses on broader benefits. By comparison, 45% of respondents focus on DC pensions/retirement, whilst 21% focus on DB pensions/retirement.

Our point of view: Organisations are taking a more holistic view of global benefits governance. Whilst DB pensions/retirement are reducing in significance, the effective management of health and wellbeing benefits are becoming more important (and challenging).

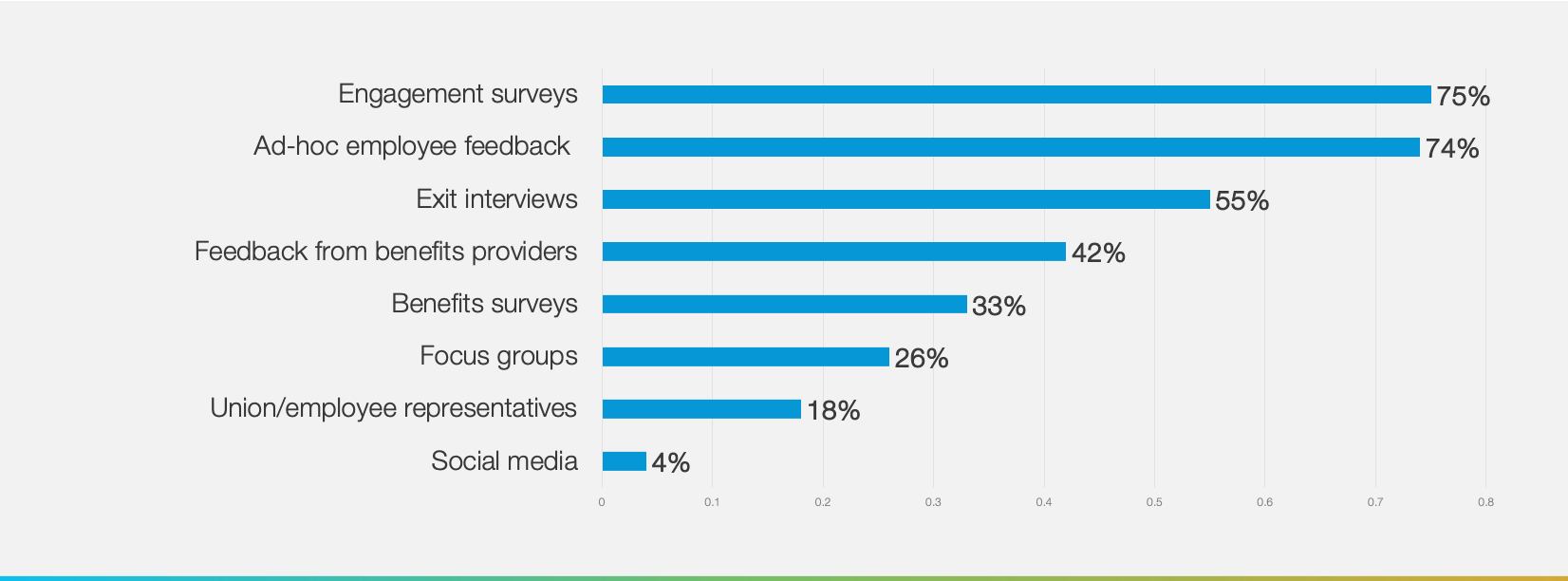

Understanding employee fit is critical – and challenging

More proactive modes of gathering feedback on benefits see relatively low prevalence – 33% of respondents use benefits surveys whilst 26% use focus groups. Whilst engagement surveys are used by 75% of respondents, these consider all aspects of employee engagement and may provide limited insights on benefits.

Whilst relying on ad-hoc feedback (74% of respondents) may reveal areas where improvements in benefits could be considered, this may not provide the full picture on benefits.

Our point of view: Benefits should be designed to fit the needs of employees. Employee listening on benefits is essential to ensure benefits are well targeted.

Organisations need to explore ways to harness employee views more proactively.

Flexible working and employee wellbeing are key future benefits for employers

Looking forward 3 years, flexible working is expected be the most important benefit for organisations’ EVP (59% of respondents), with employees’ physical, mental and emotional wellbeing close behind (56% of respondents).

Interestingly healthcare/medical benefits are expected to be less important to EVP in 3 years’ time, ranking similarly to retirement/pensions.

Our point of view: Against a tight talent market, employers are handling the “return to the workplace” carefully. Continuing to offer flexibility to employees – both in terms of the hours they work and where they do so – will be key as organisations transition to a hybrid working model going forward. Employee wellbeing is and will remain a key focus for global organisations.

Contacts

John-Paul (JP) Augeri

Managing Director and Global EB Consulting Leader, Milliman

VIEW PROFILE

Email:

johnpaul.augeri@milliman.com

Tel: +1 347 541 1146

John-Paul (JP) Augeri

Managing Director and Global EB Consulting Leader, Milliman

A global human capital and risk management leader with wide-ranging technical and management experience.

JP joined Milliman to lead the Global Employee Benefits Consulting Practice, in partnership with MBWL. He has over twenty years’ experience helping multinational clients to design, deliver and manage programs globally across pensions, benefits and M&A. He specialises in solving complex global issues and delivering value and innovation to multinationals and their employees.

His expertise includes: global pensions and benefits; M&A; funding, investment, and derisking strategies; change management; total rewards and employee experience; global client management and business development.

He has also served as a board chair and senior advisor, as is a frequent external speaker who has helped lead several client roundtables.

JP is a Fellow of the Institute of Actuaries in the UK, and he has lived and worked in the US, UK, Germany, and Austria.

Mark Whatley

Principal and Consulting Actuary, Milliman

VIEW PROFILE

Email:

mark.whatley@milliman.com

Tel: +65 63272311

Mark Whatley

Principal and Consulting Actuary, Milliman

A highly driven employee benefits and retirement specialist internationally.

Mark provides independent and objective consulting advice on employee benefits to multinationals, local companies and government-linked organisations.

Mark has over 23 years of employee benefits, retirement and financial services experience gained in Asia, Europe and Africa.

Before joining Milliman, Mark headed Willis Towers Watson’s benefits consulting business in South East Asia for over seven years, with teams in five countries.

Mark is an expert on benefits and retirement practice in each market in the region, gained from single and multi-country project experience, including; benefits review and optimisation, retirement plan design, retirement actuarial valuation, retirement and benefits administration, flexible benefits design and pricing, benefits communication, pre-M&A benefits due diligence and post-M&A benefits harmonisation. He has also worked on several multi-streamed HR transformation projects across the region.

Contacts

John-Paul (JP) Augeri

Managing Director and Global EB Consulting Leader, Milliman

VIEW PROFILE

Email:

johnpaul.augeri@milliman.com

Tel: +1 347 541 1146

John-Paul (JP) Augeri

Managing Director and Global EB Consulting Leader, Milliman

A global human capital and risk management leader with wide-ranging technical and management experience.

JP joined Milliman to lead the Global Employee Benefits Consulting Practice, in partnership with MBWL. He has over twenty years’ experience helping multinational clients to design, deliver and manage programs globally across pensions, benefits and M&A. He specialises in solving complex global issues and delivering value and innovation to multinationals and their employees.

His expertise includes: global pensions and benefits; M&A; funding, investment, and derisking strategies; change management; total rewards and employee experience; global client management and business development.

He has also served as a board chair and senior advisor, as is a frequent external speaker who has helped lead several client roundtables.

JP is a Fellow of the Institute of Actuaries in the UK, and he has lived and worked in the US, UK, Germany, and Austria.

Mark Whatley

Principal and Consulting Actuary, Milliman

VIEW PROFILE

Email:

mark.whatley@milliman.com

Tel: +65 63272311

Mark Whatley

Principal and Consulting Actuary, Milliman

A highly driven employee benefits and retirement specialist internationally.

Mark provides independent and objective consulting advice on employee benefits to multinationals, local companies and government-linked organisations.

Mark has over 23 years of employee benefits, retirement and financial services experience gained in Asia, Europe and Africa.

Before joining Milliman, Mark headed Willis Towers Watson’s benefits consulting business in South East Asia for over seven years, with teams in five countries.

Mark is an expert on benefits and retirement practice in each market in the region, gained from single and multi-country project experience, including; benefits review and optimisation, retirement plan design, retirement actuarial valuation, retirement and benefits administration, flexible benefits design and pricing, benefits communication, pre-M&A benefits due diligence and post-M&A benefits harmonisation. He has also worked on several multi-streamed HR transformation projects across the region.