France: Reform of supplementary pension plans – Loi PACTE

France’s “Loi PACTE” is introducing reforms to both defined contribution (DC) and defined benefit (DB) company pension plans with changes taking effect from late 2019 onwards.

Supplementary DC pension plans

A new type of DC pension plan is being introduced: the Plan d’Épargne Retraite or PER. These new plans will be launched on 1 October 2019 and will replace all current supplementary DC plans, including the current PERCO and PER Entreprises (or “Article 83”) plans.

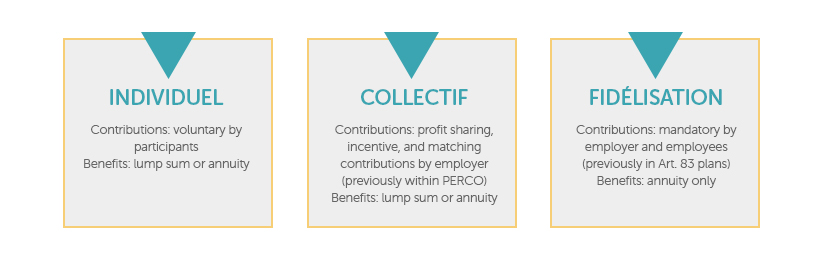

The new PER will have three sections:

In the same way as is currently permitted in a PERCO, a PER will also be able to accept savings in the form of transfers of untaken holiday days or CET days in the “collectif” section.

Plan participants will be able to withdraw their funds on retirement. Benefits may be taken earlier in specified circumstances, which are expected to include death, invalidity, unemployment (after the insurance benefit runs out) and, for the “individuel” and “collectif” sections only, the purchase of the employee’s principal residence.

The “individuel” and “collectif” sections must be open to all the company’s employees and offer the participants the same contribution and investment arrangements.

The “fidélisation” section offers companies greater flexibility in its design. This section can be offered to all of the company’s employees or to certain employee categories only, and the contribution and investment structure can differ between employee categories. For example, different employee categories may have different mandatory contribution rates.

PER providers will be insurance companies, banks and asset managers. This will open up the market compared to the current position where only insurers are authorised providers for Article 83 plans, and the banks and asset managers are PERCO providers. It will also require development from providers in terms of investment options. One of the objectives of the reform is to encourage plan participants to invest their pension assets more appropriately for the long-term. The default investment option is to incorporate a lifecycle-type investment strategy (“gestion pilotée”), where the exposure to equity investments and risks is adjusted based on the participant’s investment horizon. Currently many pension assets are invested in government and corporate bonds via insurance company funds (“fonds en Euro”).

From 1 October 2020, all new supplementary DC plans must be set up as PERs, as banks, asset managers and insurers will no longer be authorised to set up new PERCO or Article 83 plans. Employers will need to work with their current plan providers to transfer all existing DC plan assets to a new PER arrangement by 31 December 2023. They will also need to consider an appropriate design for their new PER that satisfies the company’s objectives and meets their employees’ needs. Companies with both PERCO and Article 83 plans will wish to review their plan providers as well as the future contribution structure and investment approach with a view to selecting a single provider for their new PER.

Supplementary DB pension plans

The changes for DB pension plans will take effect from 1 January 2020. They implement the requirements of the EU Directive 2014/50, also known as the “Portability Directive”. A typical supplementary DB plan in France will pay benefits to employees at retirement only if the employee is still in employment with the company at that time. This will change going forward, as benefits will vest and DB plans will need to be externally funded and meet specific conditions to benefit from favourable tax treatment. These conditions include:

- A maximum accrual rate of 3% of annual salary, with an overall maximum benefit of 30% (sum of the annual accrual rates, e.g. 10 years’ accrual at the 3% maximum rate) for the employee’s whole career with all of their employers.

- The acquired rights are revalued each year for both active and deferred members at a rate of up to the annual revaluation of the social security ceiling.

- For corporate officers and employees with annual remuneration in excess of 8 times the social security ceiling (approximately €325,000), benefit accrual is subject to satisfying performance conditions.

- The plan benefit is an annuity at retirement.

The changes apply to all new DB plans that are set up. The effect for existing supplementary DB plans varies:

- DB plans still open to new entrants after 20 May 2014 (the publication date of the Directive) are closed to new entrants with effect from 4 July 2019 (if they were not closed earlier), and benefit accrual for existing participants stops on 1 January 2020. However, participants’ accrued benefits can retain a link to future salary increases. There is no change to the vesting requirements for the accrued benefits. For a typical plan, the non-vested accrued benefits would only be paid if the employee retires from active service.

- DB plans closed to new entrants before 20 May 2014 are not affected by the changes. Participants can continue to accrue future service benefits under the old rules.

Employers with an existing supplementary DB plan that was open to new entrants after 20 May 2014 will need to decide by the end of 2019 how they will crystallise the accrued benefits (whether with a future salary link or without). They will also need to communicate with participants on the value of their accrued (non-vested) rights and assess the impact on the company’s financials. Employers will also wish to consider whether to set up a new supplementary DB pension plan, which continues to be an effective way of providing significant pension rights for high earners.

Contacts

Isabel Coles

Head of International Consulting, MBWL International

VIEW PROFILE

Email:

isabel.coles@mbwl-int.com

Tel: +44 20 3949 5710

Isabel Coles

Head of International Consulting, MBWL International

A multilingual expert in employee benefits for multinational corporates.

Isabel heads up MBWL International, advising multinational organisations on their employee benefits arrangements around the world, with a focus on corporate sales and purchases, accounting disclosures and the financing, risk management and design of benefit plans.

Her vast experience includes leading global accounting consolidations under international, UK and US accounting standards for multinational companies headquartered in the UK and overseas – with consolidations ranging in size from two to over 50 defined benefit plans.

She has advised both corporate and private equity buyers on the employee benefit considerations (including pension liabilities) associated with corporate sales and purchases in Europe and worldwide, from due diligence through to closing and subsequent integration work. Isabel has also undertaken many benefit audits and benchmarking exercises, including a 25-country audit for a company in the technology sector.

Other areas of Isabel’s expertise include reviewing and establishing international pension plans, advice on individual expatriate employee benefit packages and supporting multinationals in agreeing and implementing global governance approaches and policies for managing their employer benefit plans.

Isabel chairs the International Committee of the Association of Consulting Actuaries and is fluent in German and French.

Contacts

Isabel Coles

Head of International Consulting, MBWL International

VIEW PROFILE

Email:

isabel.coles@mbwl-int.com

Tel: +44 20 3949 5710

Isabel Coles

Head of International Consulting, MBWL International

A multilingual expert in employee benefits for multinational corporates.

Isabel heads up MBWL International, advising multinational organisations on their employee benefits arrangements around the world, with a focus on corporate sales and purchases, accounting disclosures and the financing, risk management and design of benefit plans.

Her vast experience includes leading global accounting consolidations under international, UK and US accounting standards for multinational companies headquartered in the UK and overseas – with consolidations ranging in size from two to over 50 defined benefit plans.

She has advised both corporate and private equity buyers on the employee benefit considerations (including pension liabilities) associated with corporate sales and purchases in Europe and worldwide, from due diligence through to closing and subsequent integration work. Isabel has also undertaken many benefit audits and benchmarking exercises, including a 25-country audit for a company in the technology sector.

Other areas of Isabel’s expertise include reviewing and establishing international pension plans, advice on individual expatriate employee benefit packages and supporting multinationals in agreeing and implementing global governance approaches and policies for managing their employer benefit plans.

Isabel chairs the International Committee of the Association of Consulting Actuaries and is fluent in German and French.