2022 Global Benefits Priorities Survey: A Focus on Wellness, ED&I, Flexibility and Cost

At MBWL International, we believe that staying well-informed regarding top concerns of global organizations is vital. As a result, we conducted a survey in Q1 2022 to establish top priorities for organizations around the world related to Benefits. In Canada, this survey was conducted in partnership with Normandin Beaudry.

Equipped with the resulting data collected along with insightful comments gathered during our webinars conducted worldwide, we continued exploring top relevant concerns.

In this article, we explore four key themes – Equity, Diversity, and Inclusion (ED&I), Wellness, Flexibility, and Cost – with the aim of bringing organizations greater insights regarding their Group Benefits strategies in a challenging economic environment and tight labor market.

Canadian Learnings

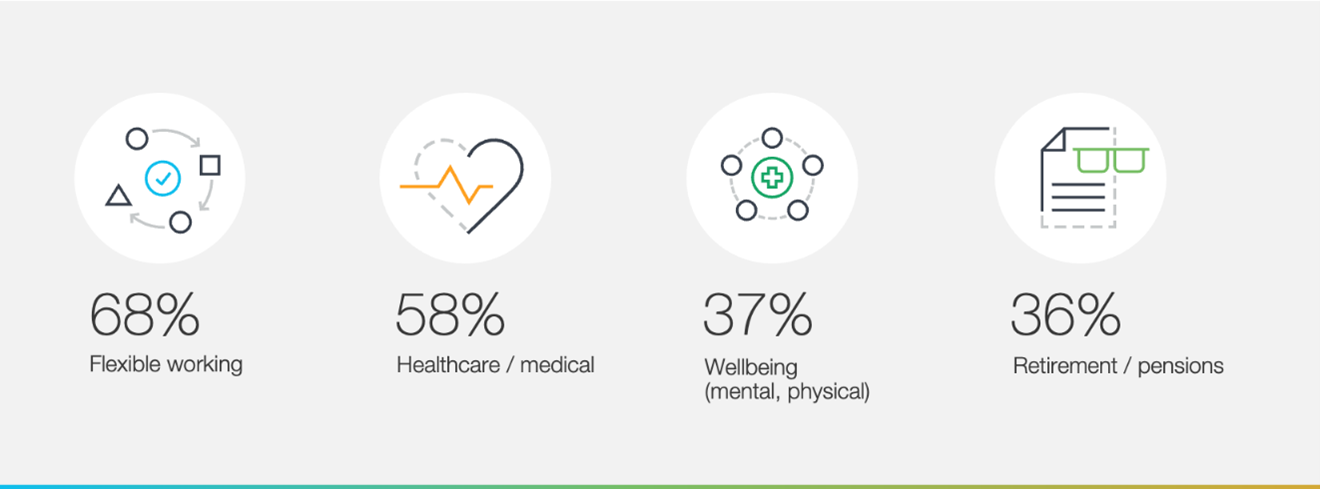

When looking specifically at the survey results in Canada, the 91 participating organizations identified the following elements as being among their Top Three most important programs for their Employee Value Proposition:

Cost also emerged as an important concern for 86% of survey participants, who indicated that it is their top consideration when designing or reviewing their Benefits.

Moreover, 60% of survey participants said that their Benefits budget increased this year compared to the previous one. Many organizations are experiencing increasing challenges due to rising inflation putting greater pressure on Group Benefits plans. Therefore, organizations want to ensure that the money invested in them positively impacts employee perception of their Total Rewards package.

The survey results point to the need for organizations to take a critical look at their Group Benefits (e.g. healthcare/medical) and wellbeing programs to ensure they are the right fit – both for the organization and for employees.

Overall employee wellbeing approach (physical, mental, financial)

We consider overall employee wellbeing to be the primary program, of which Group Benefits is a component. By adopting this vision, organizations can develop their own wellbeing framework and then attach all other programs under this umbrella and impactfully engage with employees regarding their offer.

Organizations should start with a full assessment of their current wellbeing offer (this inventory is often surprisingly vast) and establish guiding principles for their strategy. If there is a lot to be done, they can start by using a building block approach that can be developed over time.

Mental health is frequently the first area selected by organizations to start their overall wellbeing journey. Alongside providing an enhanced list of eligible specialists and increased covered amounts, some beneficial offerings include technology enabled services, paramedical services, and targeted stress management initiatives. Ideally, this should be done in combination with a mental health awareness-raising campaign for managers and employees.

ED&I

Gender affirmation and enhanced fertility coverage are two categories that can easily be improved. However, improved ED&I compliance starts with an in-depth initial assessment through which an organization will be well prepared to adopt a building block approach and engage employees in the process. To help organizations complete this initial phase, we developed an assessment tool which analyses 12 spheres of diversity and over 40 criteria of ED&I. This tool also highlights areas to improve and prioritize with the current carrier according to which solutions are available.

Accessibility of care is often overlooked. For instance, an employee’s location may impact their access to required health services. However, expanding coverage to include a wider range of specialties and services improves accessibility. This is an area where technology can also be leveraged to greatly reduce the accessibility gap. A plan can become more inclusive for lower income employees through increased annual caps for mental health coverage for example. Such an approach removes the financial barrier that might prevent people seeking much-needed care.

Flexibility

Flexibility goes beyond working arrangements/environment and can be applied to Group Benefits as well. The challenge lies in how to increase flexibility without increasing plan complexity. Organizations can adopt flexibility without having to go with a full “à la carte” approach as too many choices can be more confusing than helpful for employees. For example, in Canada employers often offer their employees a Health Care Spending Account (HSA) letting them control how and when they spend the available amount.

Furthermore, giving employees the option of putting a portion of the HSA into a Personal Spending Account (PSA) for even more flexibility is valued by many of them. This approach also extends what is eligible for reimbursement in the PSA like electric car accessories or non-traditional medicine that may not be included in the benefits plan.

Cost management

All these changes may be of interest and employees are expecting a lot from their employer, but today, organizations find themselves under financial pressure. And yet, they need to be more attractive and make sure that their employees value their Total Reward package. The building blocks approach can enable organizations to spread improvements over a few fiscal years and continually evaluate how their plan costs are evolving.

There is also the opportunity to conduct a financial efficiency diagnosis to ensure that all fees and costs are optimized and if not, reinvest any savings to enhance the plan. Furthermore, the past few years have been focused on a mindset of ‘spending for improvements’ and we believe that a consolidation phase is likely to be ahead of us. The cost pressures and labor shortage will play as opposing forces and, as a result, we believe that major benefit cuts to reduce costs is a low probability scenario.

Conclusion – Lessons that can be applied now, locally and globally

Our survey shows that getting Benefits right is not just the foundation to supporting employee health and wellbeing, they are also key drivers of organizational culture. It is therefore more critical than ever to provide a differentiated Employee Value Proposition to attract, retain, and motivate key talent. This is true in Canada and consistently the case worldwide.

By reviewing and updating Group Benefit programs through a lens of inclusion, diversity, and equity, flexibility, overall health, and wellbeing, leading organizations can demonstrate their commitment to these values in powerful and compelling ways. By improving flexibility and accessibility of Group Benefits, organizations can greatly increase employees’ appreciation and perceived value. Moreover, these actions can help to ensure organizations focus on what matters most to employees and therefore optimize their Group Benefits investment.

In the current era where employee experience is at the forefront, organizations need to recognize that communication should be used to support their initiatives. Focusing on addressing employees’ needs, concentrating on being more engaging and less technical when explaining benefits are of utmost importance. Companies need to use varied communication channels and concentrate on being concise, relevant, and impactful.

We believe these themes represent a significant challenge and tremendous opportunity for organizations. We are excited to be actively involved in the conversation and help support the health and wellbeing of people everywhere.

To learn more and see the full details about the survey methodology, participation, and results, please refer to the Global benefits client survey results.

Contacts

John-Paul (JP) Augeri

Managing Director and Global EB Consulting Leader, Milliman

VIEW PROFILE

Email:

johnpaul.augeri@milliman.com

Tel: +1 347 541 1146

John-Paul (JP) Augeri

Managing Director and Global EB Consulting Leader, Milliman

A global human capital and risk management leader with wide-ranging technical and management experience.

JP joined Milliman to lead the Global Employee Benefits Consulting Practice, in partnership with MBWL. He has over twenty years’ experience helping multinational clients to design, deliver and manage programs globally across pensions, benefits and M&A. He specialises in solving complex global issues and delivering value and innovation to multinationals and their employees.

His expertise includes: global pensions and benefits; M&A; funding, investment, and derisking strategies; change management; total rewards and employee experience; global client management and business development.

He has also served as a board chair and senior advisor, as is a frequent external speaker who has helped lead several client roundtables.

JP is a Fellow of the Institute of Actuaries in the UK, and he has lived and worked in the US, UK, Germany, and Austria.

Daniel Drolet

Senior Partner, Group Benefits at Normandin Beaudry

Contacts

John-Paul (JP) Augeri

Managing Director and Global EB Consulting Leader, Milliman

VIEW PROFILE

Email:

johnpaul.augeri@milliman.com

Tel: +1 347 541 1146

John-Paul (JP) Augeri

Managing Director and Global EB Consulting Leader, Milliman

A global human capital and risk management leader with wide-ranging technical and management experience.

JP joined Milliman to lead the Global Employee Benefits Consulting Practice, in partnership with MBWL. He has over twenty years’ experience helping multinational clients to design, deliver and manage programs globally across pensions, benefits and M&A. He specialises in solving complex global issues and delivering value and innovation to multinationals and their employees.

His expertise includes: global pensions and benefits; M&A; funding, investment, and derisking strategies; change management; total rewards and employee experience; global client management and business development.

He has also served as a board chair and senior advisor, as is a frequent external speaker who has helped lead several client roundtables.

JP is a Fellow of the Institute of Actuaries in the UK, and he has lived and worked in the US, UK, Germany, and Austria.

Daniel Drolet

Senior Partner, Group Benefits at Normandin Beaudry