Global Benefits (DE&I) – new pay transparency laws and broader impact for benefits

MBWL presented its annual Global Benefits Forecast earlier this year, detailing the findings of a survey we conducted amongst multinational employers across different industries around the globe.

In this article we discuss our findings on one of the themes we covered, namely Diversity, Equity and Inclusion (DE&I), with particular focus on one area where we saw less emphasis this year – pay gaps. With increasing global legislation around pay transparency and reporting pay gaps, this is an area that will require greater focus by employers in the next few years. We’ll discuss the issues companies are facing and the broader impact for global benefits.

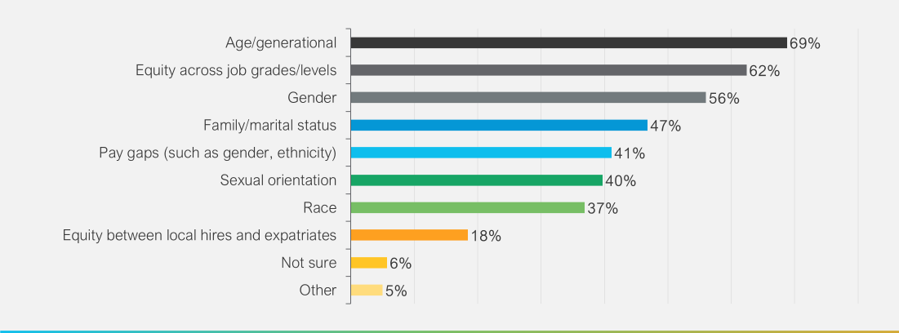

We asked survey participants:

“Which of the following aspects of DE&I need attention when it comes to designing and managing your organisation’s benefits?”

Age/generational considerations and equity across job grades are the top two aspects of DE&I that organisations feel need the greatest attention. Providing a benefits package that is flexible enough to cater to all employees’ needs at different times in their life is challenging, and so it is not necessarily surprising that this area comes out on top. We also see organizations trying to move towards equity across job grades. For example, it’s hard to justify why the medical needs of a senior employee are any different to that of a more junior employee. That said, employers are struggling to make change in practice, where the challenge is either reducing benefits for senior employees or enhancing benefits for junior employees, impacting competitive positioning and/or costs.

Perhaps the most interesting result, when we compared this year’s results on this topic with our survey results from 2022, was that there appears to be less attention given to pay gaps (54% (2022) versus 41% (2023)). It’s possible organisations feel they’ve already made good progress in this area, which is probably true, but it continues to be an important area for focus with much more to be done.

Global Pay Gap and Pay Transparency Legislation

Pay gap and pay transparency legislation is increasing around the world with more and more countries looking to address this important topic. Examples for the UK and the EU are discussed below.

In the UK, gender pay gap reporting has been a legal requirement (for companies with more than 250 employees) since April 2017. When we looked at the responses from the UK participants of our Global Benefits Forecast survey, pay gaps rated higher as a focus area (53% (UK) versus 41% (global)).

The UK Government is going one step further and has this year announced guidance for companies on ethnicity pay gap reporting. Whilst reporting is voluntary for now, some companies are already choosing to report this information and it’s possible this may become a requirement in future – there is a perception and transparency risk of not reporting ethnicity pay gaps, which could hamper the efforts of organisations recruitment and retention of a diverse workforce.

Ethnicity pay gap reporting is, however, much more complex than gender pay reporting. While gender pay analysis only involves a comparison between two groups, ethnicity pay analysis can potentially involve many more ethnic groups, depending on how ethnically diverse a workforce is.

Earlier this year, the European Parliament approved the Pay Transparency Directive and member states will have three years to transpose its provisions into national law. With this directive, Europe aims to implement concerted and consistent measures to close the gender pay gap. Among other things, the directive gives employees access to the information needed to determine whether they are being treated fairly compared to employees in the same company and gives employees the necessary tools to claim their right to equal pay.

Whilst the pay gap reporting directives have clear implications for employers around reporting on pay, there are also implications for benefits that employers may not be considering and may also need to be assessed. Under the EU directive, EU companies will be required to share information on pay and take action if their gender pay gap exceeds 5%. Pay in this case includes benefits (in cash or in-kind) and so employers may also need to consider the value of pension and other benefits.

Broader impact for pension and other benefits

In fact, according to the OECD, the gender gap in pensions in the EU is substantially higher than the gender pay gap which stands at 13%. This is because, on top of often having worked in lower paid jobs, women are more likely to have worked part-time and to have had longer career breaks. Since pension benefits are often earnings-related, these differences in career profiles between men and women can lead to large gender disparities in pension payments. Moreover, having often spent more time caring for children or relatives over their lifetimes, women may face difficulties in meeting contributory requirements and are therefore more likely to receive only minimum pension payments.

Clearly pay transparency legislation such as that in the UK and the EU is a step in the right direction towards tackling the financial inequity between men and women, but how else can companies support their female workforce through carefully considered and targeted employee benefit plans? Some examples include:

- Enhanced parental leaves that support both parents to take extended time-off at full pay will give both parents the opportunity to bond with their new child, whilst also reducing the financial burden due to loss of income.

- Flexible or remote working arrangements may better help support men and women to balance their professional and parental responsibilities, continue working full-time and reduce childcare costs.

- Childcare support – an increasing number of women are leaving the workplace due to the escalating cost of nursery provision, which is exceeding, particularly young women’s, salaries.

- Paid caregiving time-off to take care of children and relatives, for example when they are sick, reduces the financial burden, typically on women, of the loss of income due to reduced working hours or taking unpaid time-off.

- Continuing to pay pension contributions and provide benefits during extended periods of time-off like parental leave will help reduce the pension and pay gap that’s often exacerbated by these career breaks.

- Women’s health for example, symptoms of menopause or menstruation, and providing support in these areas such as paid time-off, access to support and medical care may also prevent the need for women to reduce their working hours or take unpaid time-off.

In summary

Diversity, Equity and Inclusion continues to be an important topic and there is still a lot to be done, but increasing global legislation is slowly forcing the way and we’ll likely continue to see developments in this space and more countries introducing pay gap and pay transparency legislation.

Contacts

John-Paul (JP) Augeri

Managing Director and Global EB Consulting Leader, Milliman

VIEW PROFILE

Email:

johnpaul.augeri@milliman.com

Tel: +1 347 541 1146

John-Paul (JP) Augeri

Managing Director and Global EB Consulting Leader, Milliman

A global human capital and risk management leader with wide-ranging technical and management experience.

JP joined Milliman to lead the Global Employee Benefits Consulting Practice, in partnership with MBWL. He has over twenty years’ experience helping multinational clients to design, deliver and manage programs globally across pensions, benefits and M&A. He specialises in solving complex global issues and delivering value and innovation to multinationals and their employees.

His expertise includes: global pensions and benefits; M&A; funding, investment, and derisking strategies; change management; total rewards and employee experience; global client management and business development.

He has also served as a board chair and senior advisor, as is a frequent external speaker who has helped lead several client roundtables.

JP is a Fellow of the Institute of Actuaries in the UK, and he has lived and worked in the US, UK, Germany, and Austria.

Contacts

John-Paul (JP) Augeri

Managing Director and Global EB Consulting Leader, Milliman

VIEW PROFILE

Email:

johnpaul.augeri@milliman.com

Tel: +1 347 541 1146

John-Paul (JP) Augeri

Managing Director and Global EB Consulting Leader, Milliman

A global human capital and risk management leader with wide-ranging technical and management experience.

JP joined Milliman to lead the Global Employee Benefits Consulting Practice, in partnership with MBWL. He has over twenty years’ experience helping multinational clients to design, deliver and manage programs globally across pensions, benefits and M&A. He specialises in solving complex global issues and delivering value and innovation to multinationals and their employees.

His expertise includes: global pensions and benefits; M&A; funding, investment, and derisking strategies; change management; total rewards and employee experience; global client management and business development.

He has also served as a board chair and senior advisor, as is a frequent external speaker who has helped lead several client roundtables.

JP is a Fellow of the Institute of Actuaries in the UK, and he has lived and worked in the US, UK, Germany, and Austria.